Underperformance of crypto equities

WTF?

So what’s with the underperformance of crypto equities?

I’m going to illustrate the general dynamics on how the options market effects the underlying stock price

A big factor is the monthly options expiry (mopex) coming up this Friday on Nov 15 -- the dynamic is specifically:

the expectations on price movement were too high

market makers unwinding their hedges

I’m gonna use Coinbase as a concrete example here, but these factors pretty much apply with most of the crypto equities.

I’ve mentioned before that you need to look at implied volatility before aping calls precisely post-Trump win given this dynamic I am going to describe.

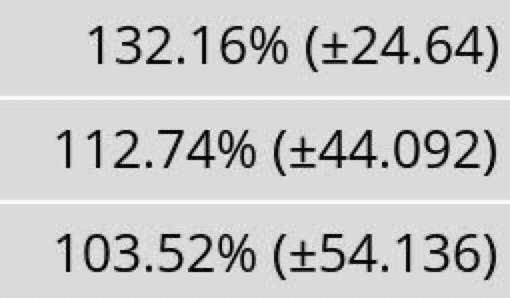

These are the implied vol values on the Nov 15, 22, 29 expiries for Coinbase.

The 132% means that the 2 standard deviation (95% probability) expected move is + or - 16.62% per day in the underlying. These expectations are very very high

The implied vol percentile over 30 days is 80%. This means that this implied vol (or expectation of the upside on the Coinbase over the next 30 days) is higher than 80% of the time. This is ridiculously high considering this doesn’t overlap with a quarterly earnings call.

So what happens when the expectations are so high? Also what are the market makers doing here?

When MMs sell you out the money calls, they will hedge their short deltas by buying shares.

As you get closer to expiries, the delta value for those out the money calls will decrease and as a result, these MMs will sell their shares to ensure they have no directional exposure

As we approach Nov 15, the OTM calls lose deltas faster and faster (all things equal)

If we look at options OI, it skews heavily towards out of the money calls (barely any puts visible in the chart).

As we get closer to the expiry date, there is an acceleration in the directional move due to the reflexivity of this MM hedging dynamic. As a result, the MMs are selling shares more and more aggressively (all things equal or until an entity comes in and bids Coinbase more aggressively).

This is perpetuated as folks take profit as well (calls closed, MM dumps shares they bought to hedge). It’s one big reflexive loop

How did we end up in this spot?

Last week options positioning was quite bearish on Coinbase (look at historical put call ratio, and the 25 delta skews).

We had a Trump win that caused a large positioning unwind (resulting in precisely the opposite of what i described above) with MMs buying back shares as their short puts unwind.

The pendulum swung hard the other way, implied vol (price!) of these options spike higher - as this happens, you have higher delta values (and hence more aggressive hedging and the inevitable unwind) for OTM calls.

The expectation for price movement moved way too much in the positive direction as you had a mix of shorts covering, MMs unwinding their hedges, and general expectations of the “supercycle” playing out. This is visible in the implied volatility across all the crypto stocks

This is also why I opted to sell a lot of vol here - these expectations are rarely met and it is a great way to hedge spot .