The Bitcoin Spot ETF and Rotisserie Chickens

And Coinbase of course..

“I’m hesitant to buy Costco stock because they are working through an approval to sell rotisserie chickens and I know that rotisserie chickens are a loss leader for grocery stores”

The spot BTC ETF is Coinbase’s equivalent of selling rotisserie chickens.

The argument I’ve heard is that the spot BTC ETF will cannibalize Coinbase’s trading volumes. Why would anyone buy BTC on Coinbase when they can buy the ETF on Fidelity or Schwab?

This myopic view falls into the classic example of “first order thinking”. It doesn’t consider any of the other implications and the potential downstream effects on Coinbase’s business.

I argue why the spot BTC ETF will be a net positive for Coinbase’s business in the medium to long term. I’ll cover:

Custodial Revenue + Surveillance Sharing Agreement

Issuance/Redemption Trading Volumes

Spot BTC ETF effect on total crypto market cap

“No one got fired for picking IBM”

Custodial Revenue + Surveillance Sharing Agreement (SSA)

These are the first order effects that Coinbase will benefit from. Coinbase will make $ via custodian fees and their surveillance sharing agreement

We know from their earnings that custody fees are 11-12 bps annually. This will likely be negotiated down further for BlackRock and Fidelity. In any case, this won't have a material affect on their top line revenue. Given the lack of mention on their recent earnings, I’d guess the SSA won’t have a significant impact on their top line revenue either.

Issuance/Redemption Trading Volumes

When shares of the ETF are issued, BTC needs to be bought. When shares are redeemed (if this mechanism exists), BTC needs to be sold.

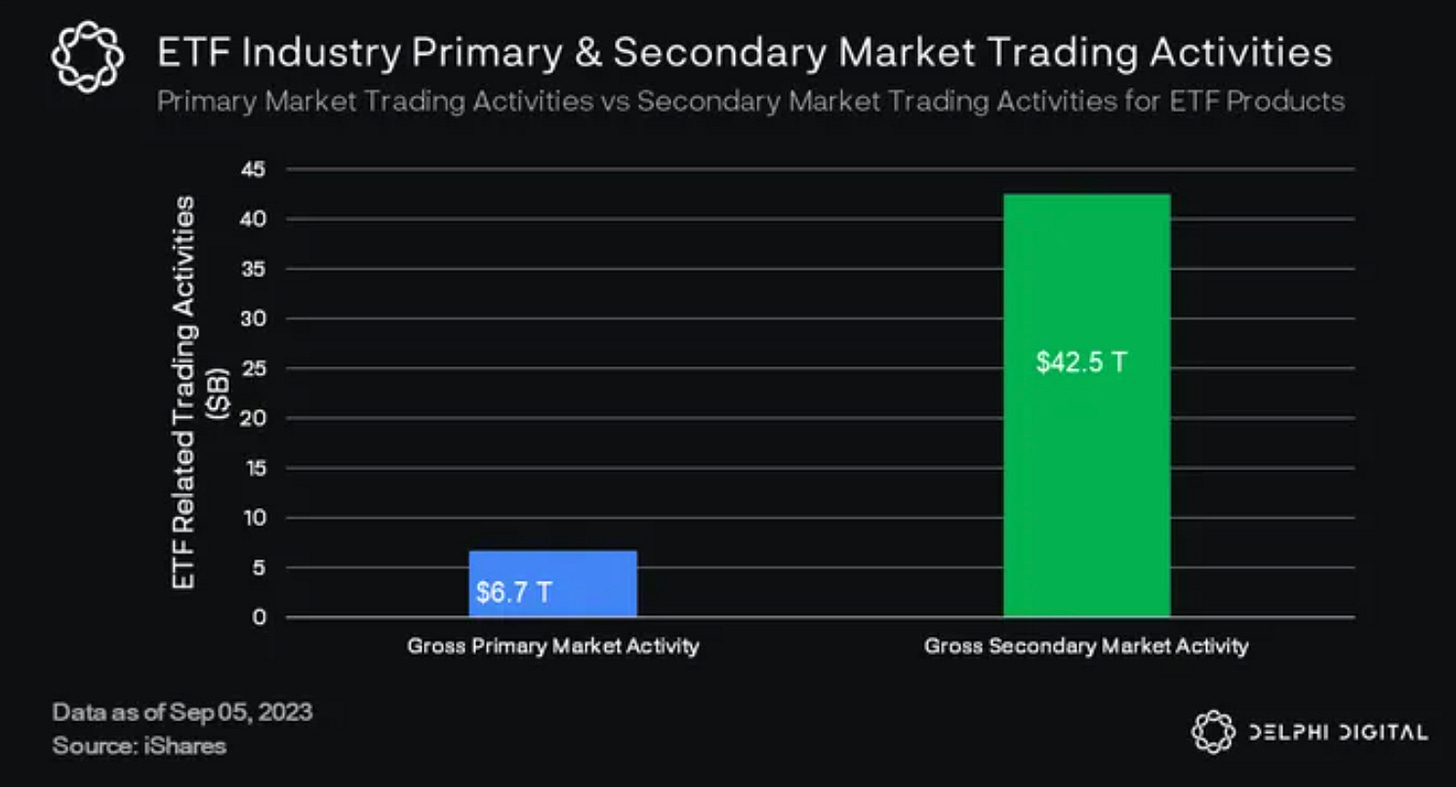

Delphi published a report that took a closer look at the ratio between various ETF trading volumes vs. the primary trading volumes. They found the ratio to be about 6:1 – this would mean for every $6 of ETF trading volume, BTC volumes would be $1.

And which exchange(s) will be the beneficiary (recipient of said BTC trading volumes)?

It’s difficult to ballpark numbers here since there are many assumptions – BTC spot price, ETF AUMs and trading volume (to name a few). However, this illustrates that Coinbase will likely capture at some of the value - atleast - that is created via the spot BTC ETF.

Spot BTC ETF effect on total crypto market cap

I said in this tweet that part of the Coinbase thesis is a bet on the total marketcap of cryptocurrencies. Why?

> Higher overall crypto prices (in USD)

> Higher staking yields (higher staking fees)

> Higher AUM (higher custodial fees)

> Higher retail/institutional interest (higher trading volumes)

The total marketcap is a multiplier on Coinbase’s business. Anything that causes the total marketcap of crypto to go up has a direct positive effect on Coinbase’s revenue.

BlackRock makes more money when the AUM for their ETF goes up. As BTC prices climb, the wealth effect trickles down and pumps other coins. The BTC spot ETF will have a positive effect on the total crypto marketcap. What follows is that Coinbase makes more money.

“No one got fired for picking IBM”

In the 70s, every institution would default to IBM for their IT solution since it was a “safe choice”. After BlackRock and Fidelity issue out their BTC spot ETF in partnership with Coinbase, we’ll hear “no one got fired for picking Coinbase”.

To add more color, sure, Bitcoin (and Ethereum) spot ETFs will exist. And for those that are ok paying a hefty AUM fee for the convenience of using BlackRock’s ETFs, great. But for anyone that wants to go a little deeper (say buy a little Solana or stake some Ethereum) what is the platform that comes to mind?

Conclusion

Yes, some of Coinbase’s BTC trading volumes may be displaced by the spot BTC ETF but there are so many other positive developments (as a result of the spot BTC ETF) that will more than offset the loss in BTC trading volumes. It’s highly likely that the spot BTC ETF will be a net benefit to Coinbase as a whole.