Modular blockchains and SaaS companies

Parallels

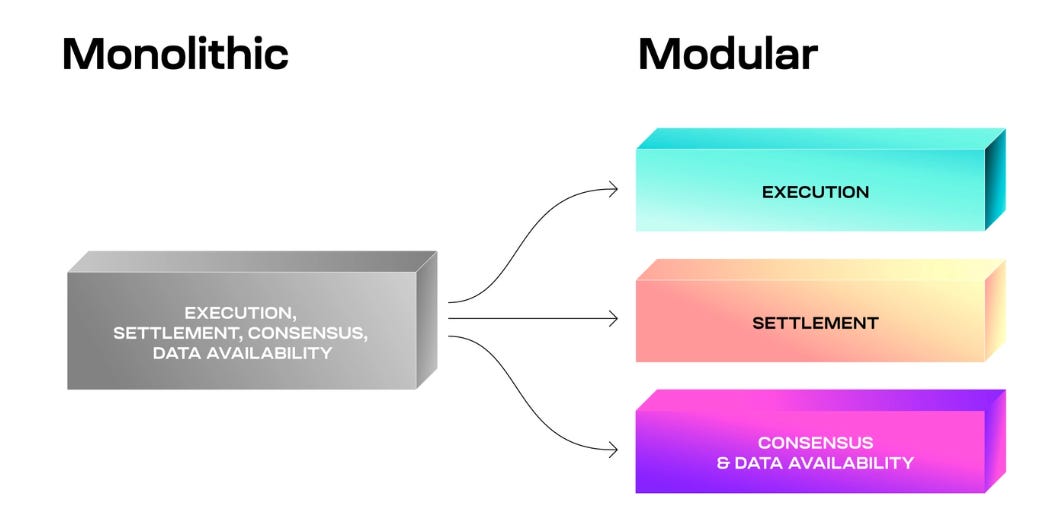

Monolithic blockchains are characterized by an architecture that groups all functions (execution, settlement, consensus and data availability) under one network.

There are pros and cons to a monolithic architecture, the most obvious con is when it comes to scaling. As we anticipate a magnitude more users coming into this space, the modular approach (separating the different functions) is coming into fashion given its advantages to scaling blockchains.

This evolution reminds me of what has happened in web2 over the past decade. After the first iteration of large, successful tech companies like Facebook and Google (which also took a similar monolithic approach), an explosion in SaaS related start-ups followed: Stripe, Slack, Shopify as examples

Big tech companies draw parallels to monolithic blockchains in that they internally built the core infrastructure required to operate any modern day tech company - payments, compute infrastructure, database solutions, and so on. There weren’t good options to outsource them at the time.

But over time, former big tech employees and starry eyed ivy league students saw an obvious opportunity to build well designed, composable abstractions that reduces friction in building and scaling start-ups. At the same time, VCs knew that there are “only two ways to make money in business: one is to bundle; the other is unbundle”.

This combination led to a new category of startups which became quickly known as SaaS (software as a service) - they were companies building scalable tooling and infrastructure, with the goal of reducing friction and common pain points in building start ups.

But with a new category, there was a meta-game at play.

This game was:

Invest in a number of SaaS businesses

Get all your portfolio companies to use each other

Boost metrics and get other VCs to rerate your investments

Find a way to exit and/or raise another fund based off the enormous mark-ups

A very clear example of where this worked extremely well was with Stripe. Stripe was a payments company that started in 2011 and went through YCombinator. Back then, payments was a big bottleneck in expanding globally - setting up a business bank account in certain countries (and accepting all the different forms of payments) was a huge pain point for many business owners.

Through YCombinator, Stripe gave away 7% of their company for 125k in funding. Beyond the capital, YC provided a network of other companies to sell to and integrate with. Stripe was one of the first companies to “sell shovels during a gold rush”. They did a phenomenal job.

So how’d things turn out?

Stripe powers (or at some point powered) Instacart, Airbnb, and DoorDash. All 4 of these are YC companies. At current valuations, 7% of each of these companies amounted to 12B dollars (from a total of a 500K investment).

Stripe, and YCombinator, certainly benefited from this approach.

But over time, as more folks came onto this strategy, it became oversaturated. There’s nothing wrong with this approach in and of itself, but when the metrics vastly overexaggerated, and latecomers inevitably FOMO, you end up with grifters and borderline fraudulent behavior (especially when rates are near zero and capital is abundant).

At the end of 2018, Chamath explicitly called out the VC industry for this.

—

While this game was very profitable to play (especially if you were early), it was extremely exclusive. Only a select set of individuals had access to these venture deals.

But now imagine:

Companies could go public without jumping through such a large set of regulatory hoops

Anyone with an internet connection (globally) could buy the equivalent of equity (or a close proxy of) in these companies

There exists a new mechanism, call it cryptoeconomic incentives, such that the equivalent of equity holders (stakers) were required to keep the company running

To add more color to 3), imagine a world where Stripe (~global payments network) and other SaaS companies function more securely if there were a larger number of unique equity holders. The corollary to this would mean that other companies building on top of Stripe would be incentivized to distribute some portion of their equity to Stripe equity holders (stakers) as they eventually go public.

Why?

Here’s a more explicit example: Instacart uses Stripe for payments. If Stripe ever went down, Instacart would have major issues in not being able to accept payments. Instacart needs to ensure that Stripe is secure (which is re-enforced by a larger number of Stripe equity holders). Therefore by setting an example of “airdropping” Instacart equity to Stripe equity holders, this incentivizes more unique individuals to buy and hold Stripe equity (and stake it). With this mechanism in place, Stripe becomes even more of an index fund on start-ups (on top of taking up a % of start-up revenue via payment fees).

And you can apply the same logic applies to other SaaS companies.

What a mechanism huh?

This state is sort of where modular blockchains are today. We can see similarities with Celestia - which is a data availability aka DA (one of the core blockchain functions) service provider.

The folks that staked Celestia have been handsomely rewarded by protocols that are building tangentially and/or integrated with Celestia. I’ve coined this mechanism as multi-level modularity in the past.

In that sense, Celestia’s fundamental metrics (revenue, profits, etc) don’t mean much.

Who cares if Celestia only makes $75/day if stakers get distributed tokens for a percentage of protocols integrate with Celestia?

Because of this model/mechanism, Celestia should be valued moreso as an index for protocols and blockchains that integrate with them. And as a result, stakeholders in Celestia would benefit if more and more protocols migrated away from existing DA solutions and integrated with Celestia. Given that markets are forward looking, the airdrops to Celestia stakers are secondary to the existence of this meta-game and narrative.

This isn’t a comment at all on Celestia’s legitimacy - they’ve helped protocols save up to 100x on their DA costs. It’s more so a commentary on the meta-game at play.

Celestia has returned a staggering 2000x from their seed round back in March 2021 to present.

Staking Celestia would’ve yielded up to a 100x on your cost basis in airdrop returns.

These type of headlines and returns inevitably grab attention. And as more folks figure out the meta-game, latecomers (both retail + institutions) will start wincing at the thought of missing the “next” Celestia..

Aevo is an options/perps DEX built on their own appchain, with one of the best options UX in DeFi - I use them myself to hedge my spot positions in a much more capital efficient manner. They are also super quick in listing the hottest pre launch tokens ($TIA, $BLAST, $PYTH) on their perp DEX

They’ve rebranded from ribbon finance and will be doing an airdrop soon. Use my this link to support me and save fees when you use Aevo