Markets and election uncertainty

Let's take a look

The US presidential election is in 2 days.

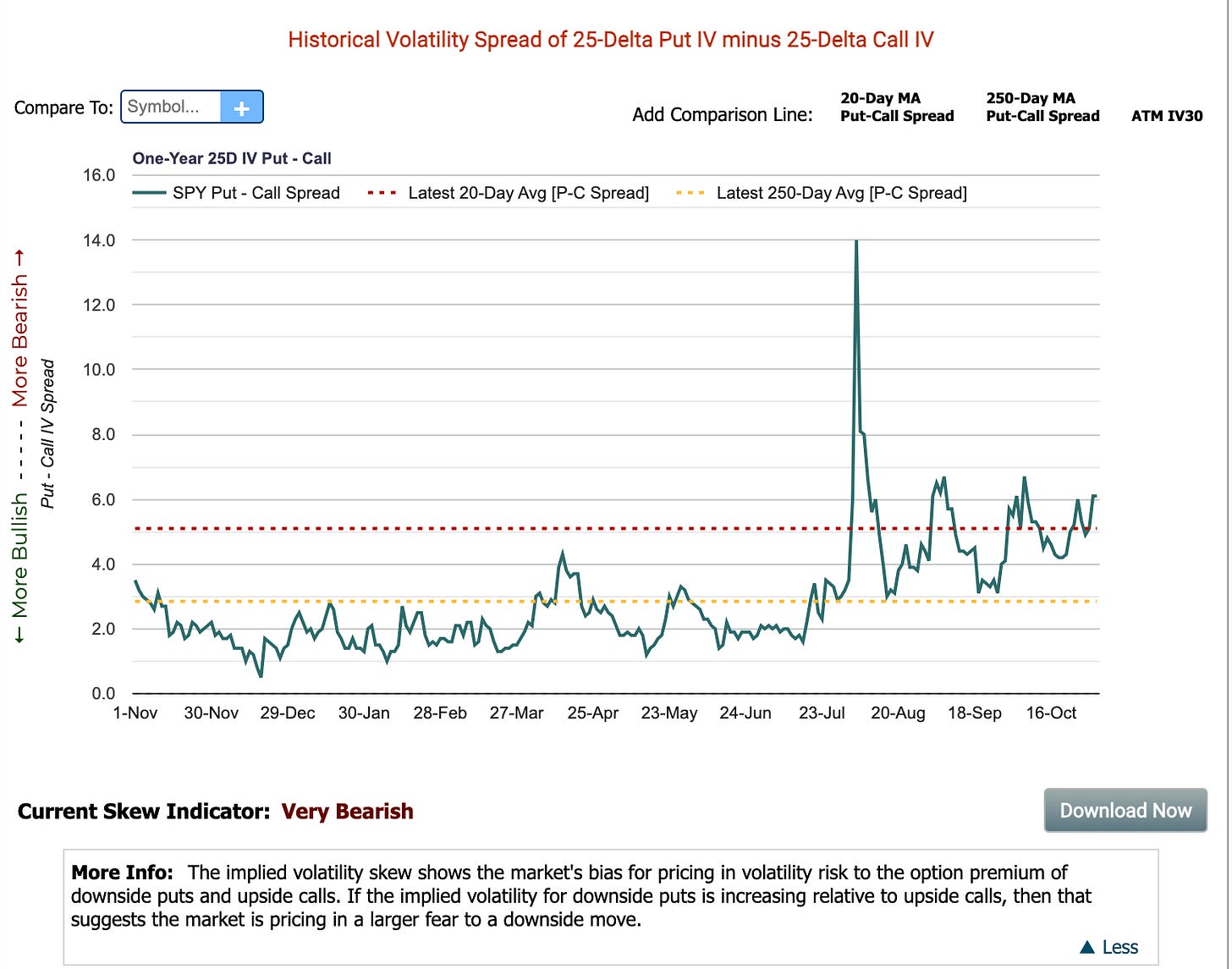

There’s a lot of nervousness in markets leading up to this. We can see this with elevated VIX values, and bearish options positioning.

But historically, how have markets fared post election? Is the fear justified at all?

Here is the 1, 3, 7, 14, 21, and 30 day post election performance in SPY for every presidential election since 1980.

Including all years, the SP500 tend to chop around and ultimately resolving slightly higher 30 days post election. If you include 2000 (dot com bubble pop) and 2008 (great financial crisis), we end up consistently grinding higher post election. Also note, in the 2000 election was contested. In 2008, Lehman Brother’s filed for bankruptcy in Sept 15, 2008.

Let’s look at implied volatility measures — roughly, this is a gauge on how much the market expects the underlying to move.

Specifically:

The VIX is a measure on the volatility over the next 30 days on SP500

The MOVE index is effectively the bond market equivalent of the VIX

Barring 2000 and 2008, the VIX was lower 30 days post election across all election years. The market hates uncertainty and this makes it evidently clear — the desire to hedge positions diminishes regardless of who the winner is.

The relationship with the MOVE index is less clear.

So are those equity hedges justified?

We can answer this by looking at the implied volatility vs. realized volatility post election. A general rule of thumb is - if implied volatility is greater than realized volatility, it is better so sell (or not buy) insurance and vice versa.

Again, barring 2000 and 2008, the spread is always positive across 7, 14, and 30 days post election. What does this mean? It means hedges are generally overpriced - specifically, the implied volatility is higher than reality and the market moves less than expected.

And how much exactly are these hedges overpriced?

We can interpret this as:

Across all election years, the price of hedges overestimates the expected move on SP500 by ~1.50%

Removing 2000 and 2008, the price of hedges overestimates the expected move on SP500 by ~2.25%

And what about a contested election?

Maybe this time is different. Maybe we get an outsized move and hedges were the right move.

But the data really leans towards: Nothing ever happens