Lido Finance: one of crypto's super aggregators

What the f*ck is a crypto super aggregator?

Ben Thompson (Stratechery) infamously coined the term “aggregators” to describe platforms that:

Have a direct relationship with users

Incur zero marginal costs for serving users

Are a demand driven, multi-sided network with decreasing acquisition cost (aka network effect)

He categorizes a subset of aggregators as “super aggregators” – those that “operate a multi sided market with at least 3 sides”. Google Search is the canonical example – they have users (people that use search), suppliers (people that create organic content), and advertisers

Lido is one of the few super aggregators within crypto, and its flywheel is spinning in full force.

First off, what is Lido? Lido is a *protocol* that allows:

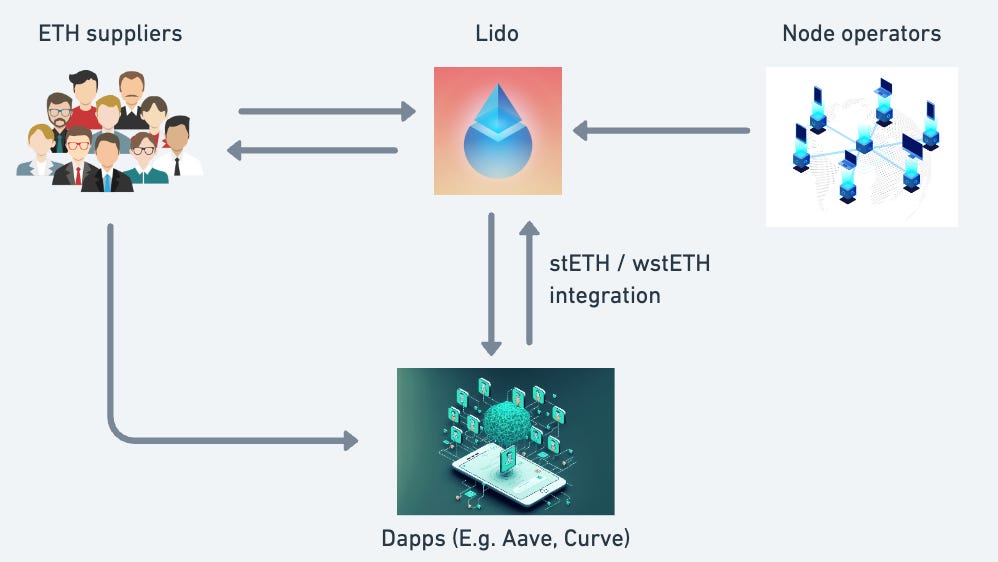

Users (suppliers) to stake their Ethereum. Lido facilitates 1) deposits less than 32 ETH, 2) without the hardware, internet, and other infra requirements and 3) provides the convenience “locking” their ETH (through liquid staking tokens – one stETH represents a share of Lido staked ETH) *

Provides ETH to node operators to scale the number of validators that they can run

It also integrates with numerous decentralized applications via its liquid staking token (stETH). This provides convenience to suppliers – stETH holders benefit from staking yields AND can use stETH to do things on-chain

* Lido also facilitates staking on other networks, for simplicity, just using ETH as examples here

So how does Lido fit within the aggregation theory framework?

Direct Relationship With Users

Suppliers deposit ETH with Lido either directly (via their website) or indirectly (swapping for stETH via an exchange)

Node operators sign up to stake – there is currently an onboarding process but this is transitioning to being self-serve via distributed validator technology (DVT)

Zero marginal costs for serving users

Suppliers incur the transaction costs (gas for direct deposits, fees for swaps) in obtaining stETH

There is a “cost” for onboarding more node operators currently. However:

There is zero marginal cost for spinning up an additional validator among existing node operators

Distributed validator technology is in the works to making onboarding self-serve

Demand Driven multi-sided networks with decreasing acquisition cost (aka network effects)

ETH is *supplied* from users that don’t have the means to solo stake and/or require the convenience that comes from liquid staking

ETH *demand* comes from node operators that want to scale out their staking operation but 1) don’t want to directional risk or 2) don’t have the capital means to purchase more ETH

Decentralized applications integrate with stETH to provide interoperability and convenience (liquidity, capital efficiency, etc) for their users – who also happen to be Lido staking suppliers

And so, customer acquisition costs across the three parties lower over time. Why?

Suppliers are incentivized by the “safety” and “convenience” that Lido brings

“Oh Lido has so much TVL, it must be safe”

“Lido has the highest LTV ratio on Aave? Let’s use Lido to avoid liquidation risk”

Decentralized apps are incentivized to integrate and integrations streamlined

“stETH is so popular, all of our dapp users are asking for it”

“Yeah we’ll follow your integration guide –it's the same thing Aave used right?”

Node operators like the scalability potential and ease of onboarding that Lido brings

“Yeah we should use lido, they have the largest growth ETH supply and we are looking to scale our validator business”

With Distributed Validator Technology (DVT), onboarding node operators is self serve”

As a result, each side of the network is more incentivized to use Lido, resulting in each marginal customer (on all 3 sides) being more attracted to the platform by the increasing number of suppliers – this virtuous cycle provides the powerful “network effect”

Regulating Aggregators

As Ben describes, “given the winner-take-all nature of aggregators there is at least in theory, a clear relationship between antitrust and aggregation”

This is already evident - there’ve been discussions on limiting Lido to a fixed % of ETH staking