Jito airdrop recap

man oh man

The past few days have been insane within the Solana ecosystem. Here’s a brief recap and some forward looking thoughts on where we go from here.

I first wrote about Jito on August 7. Four months later (Dec 7), they did their token generation event and airdrop.

Their growth has been insane going from 50K SOL TVL to 6.8M SOL staked at peak.

The airdrop overwhelmed everyone -- the consensus from a lot of folks was that a conservative FDV would be ~250-500M. And that 1B would likely be the upper bound.

JTO was trading on Coinbase for $2 within the first hour. It dumped to $1.6 in the next several hours and then rallied up to $3.28. I know on other exchanges, it traded into the $4 range. Everyone who had qualified for the airdrop were pleasantly surprised.

The airdrop was an insane ROI for anyone who had staked some SOL through jito. Any better yet:

So what happens from here on out?

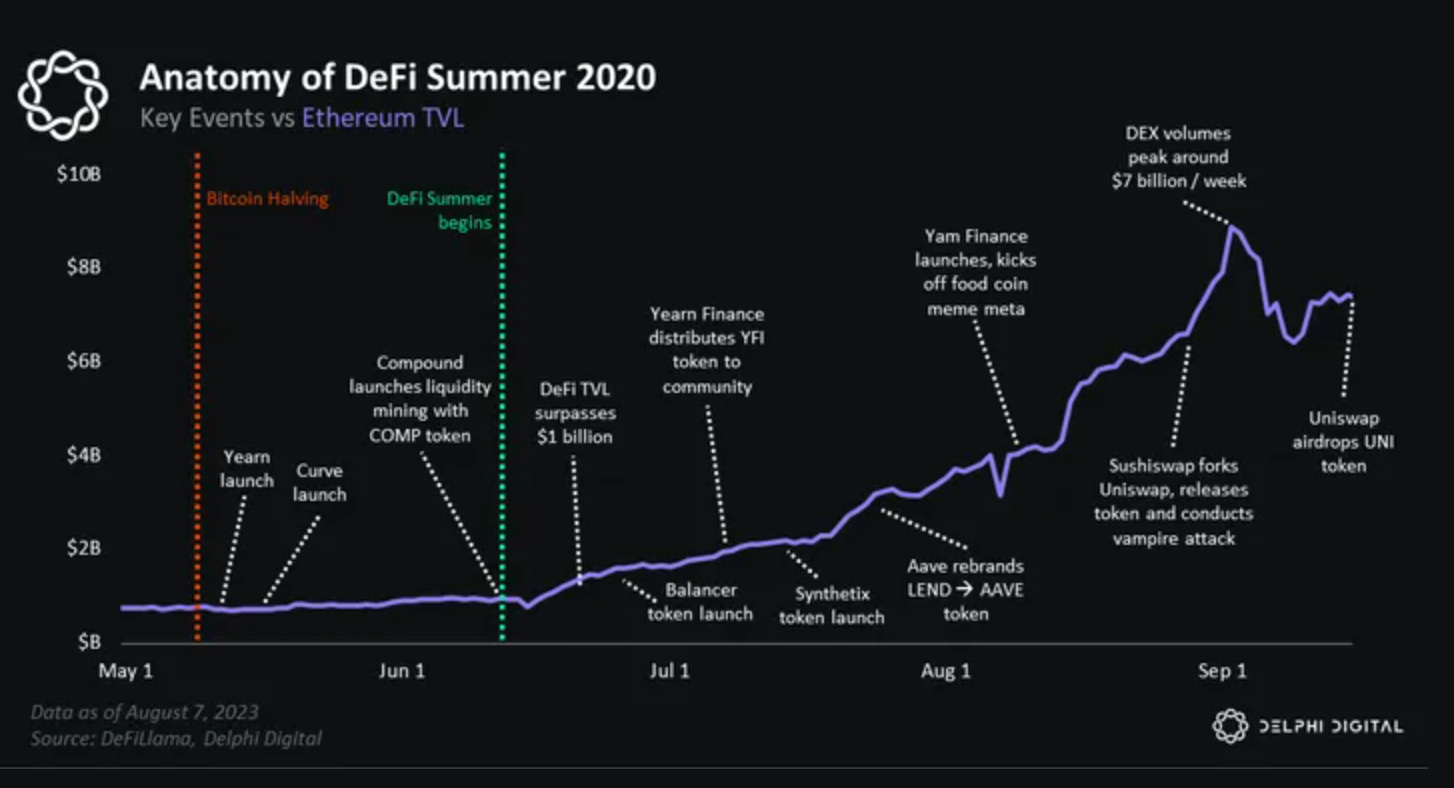

Similar to how the compound liquidity mining event really kicked off DeFi Summer on Ethereum, headed into the new year I think we get the equivalent for Solana.

All eyeballs are on Solana, everyone who saw the airdrop distribution for Jito is thinking "how do I do the same thing". We've had 48MM of net inflows from ETH to SOL just on the Wormhole bridge.

We are seeing similar things on, with 14MM of net inflows from Ethereum to Solana.

Solana is going to get an aggressive inflow of activity and attention. There are going to be magnitudes more eyeballs pouring over this ecosystem.

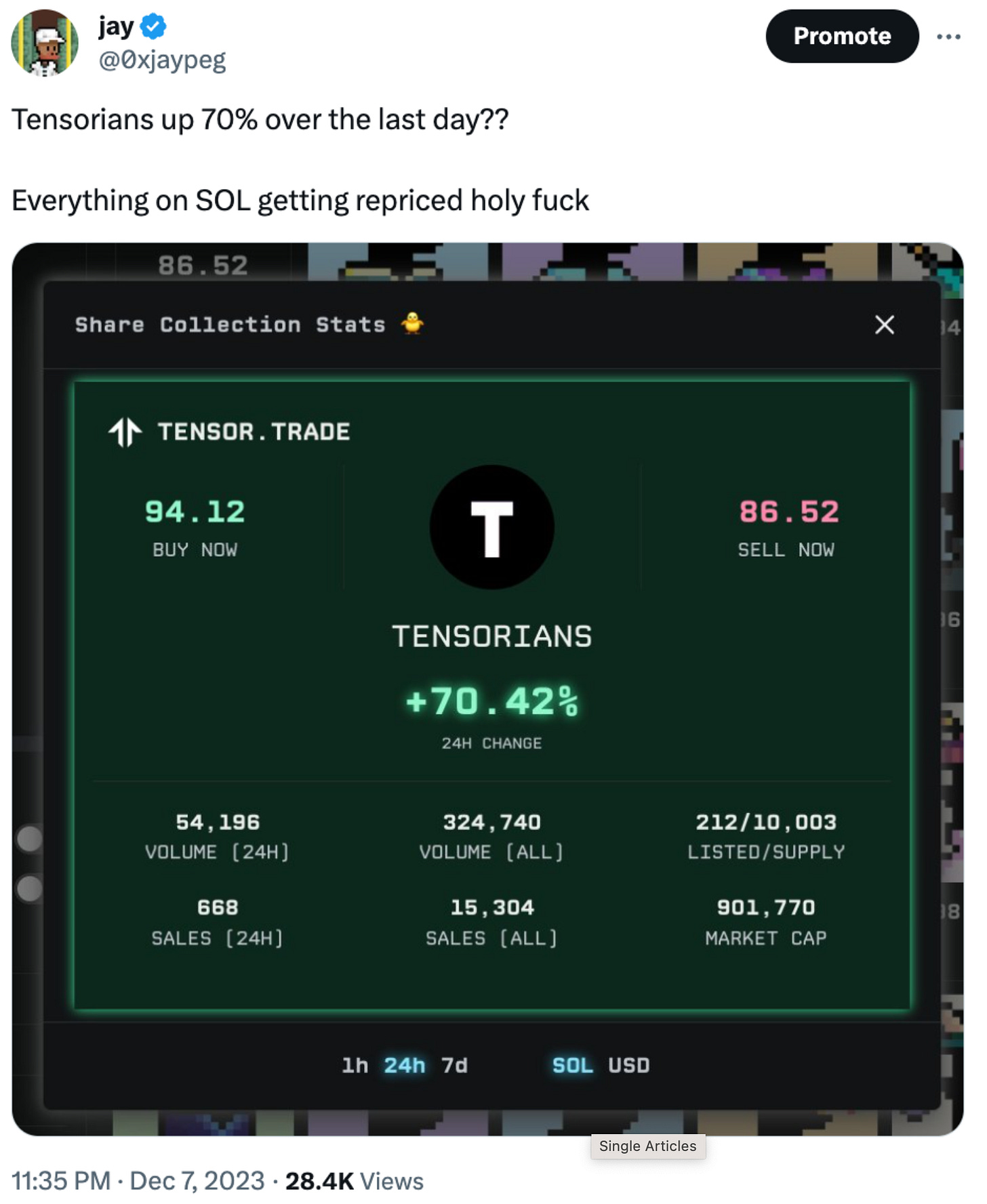

Immediately after it was apparent that JTO was trading higher than LDO - the most dominant liquid staking protocol on ETH, the comparisons between Tensor and Blur were being made. There was an immediate repricing of Tensorians which is one of the sure-fire ways of getting exposure to Tensor’s airdrop.

Here’s a more detailed write-up that outlines how you can potentially qualify for the upcoming Tensor airdrop.

Over the next 6 months everything on Solana gets repriced, some tokens and projects even an order of magnitude higher. I do think the window for qualifying for airdrops similar to Jito is quickly closing. My advice for those that want to find upside would be:

buy and stake SOL (easiest route)

use Solana organically and:

It’ll be cool to see how everything plays out.

—

This post is sponsored by Aevo. Aevo is an options/perps DEX built on their own appchain, with one of the best options UX in DeFi - I use them myself to hedge my spot positions in a much more capital efficient manner. They are also super quick in listing the hottest pre launch tokens ($TIA, $BLAST, $PYTH) on their perp DEX. If you had bid JITO when it first launched on Aevo (Dec 5), you would’ve been up > 5x.

Use this link to support me and save fees when you use Aevo!

Good recap thanks

Hi Jay can you please talk about what to do with a $TIA bag?