The Looming Opportunity with Decentralized Stablecoins -- Delphi Digital

There are no restrictions on who can create US “dollars” today – but is it really a dollar if it doesn’t clear and settle within the US?

It is consensus that stablecoins have product market fit within crypto – they are easy to transfer around and they allow for more capital efficiency against our native cryptocurrencies. In essence we’ve recreated the eurodollar market, which served a similar purpose between foreign banks (creating and loaning out excess US dollars).

Delphi’s “The Looming Opportunity for Decentralized Stablecoins” covers many of the new developments. Here are my takeaways:

Overview

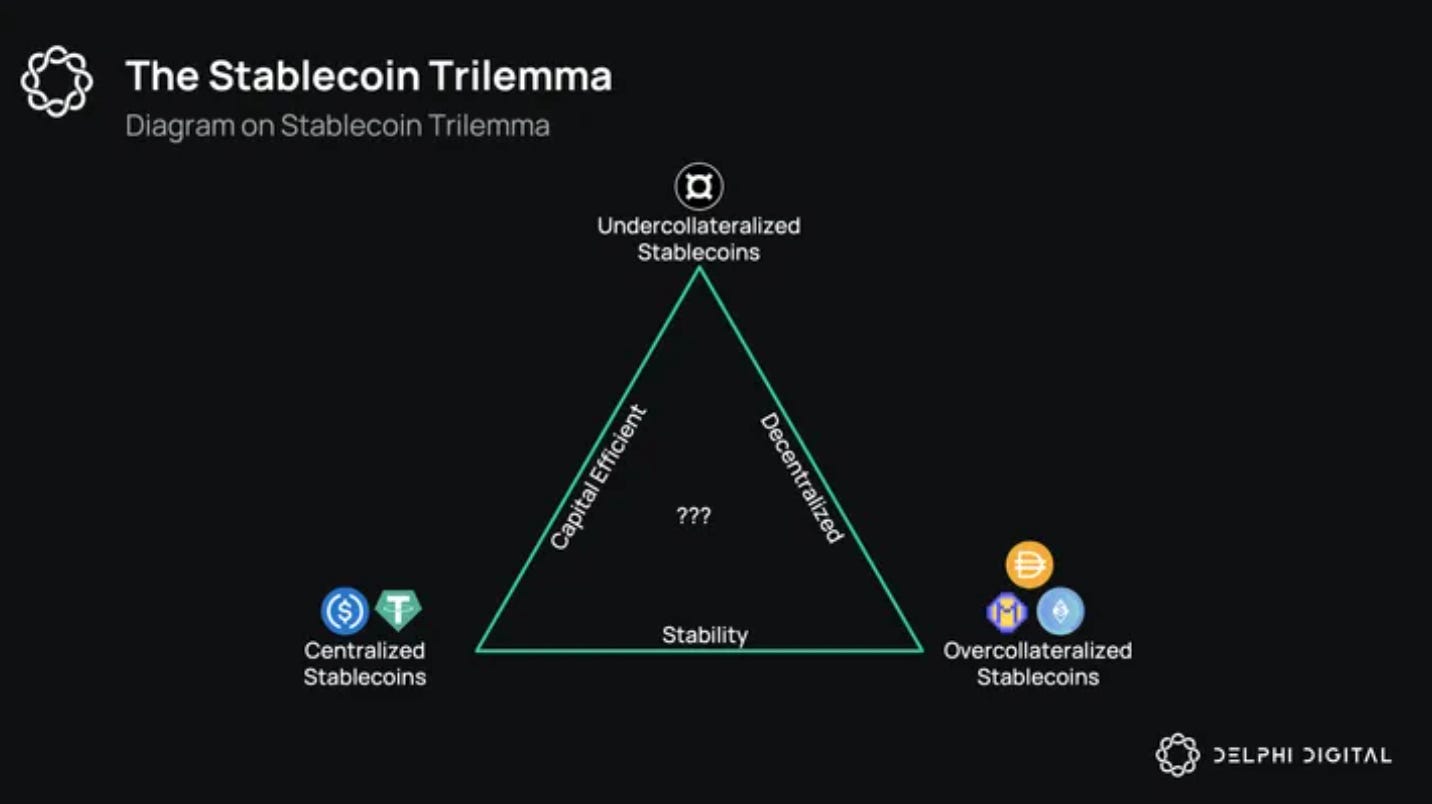

The quality of any particular stablecoin hinges on peg stability, capital efficiency, and decentralization. Given that peg stability is a deal breakers, you are really picking between overcollateralization vs. centralization

Frax, a formerly undercollateralized stablecoin, is moving to being fully collateralized (will cover in more detail)

The top 5 centralized stablecoins account for 93.24% of market share vs. the top 5 decentralized only account for 4.69% (as of Aug ‘23)

This is likely because most centralized stablecoins provide a mechanism to actually redeem and settle US dollars

More recently, there’s been a ton of developments in this space. We’ll cover:

Existing: DAI (Maker), GHO (Aave), Curve’s crvUSD, FRAX

Upcoming: Ethena, Lybra, Dinero, PayPal USD, Gnosis Pay

Maker

MakerDAO is one of the pioneer DeFi protocols (in more detail)

How does it work? You deposit collateral into a debt position, and you can mint DAI stablecoin against your collateral

And how does DAI stay at peg? The simplified explanation is:

The PSM takes your USDC and mints new DAI and gives it to you. When DAI is >$1 you can make an instant profit doing this. (take 1 USDC, trade it for1 DAI that you can sell for $1.001.)

The PSM takes your DAI and gives you USDC (while stocks last.) When DAI is >$1 you can make an instant profit doing this. (buy 1 DAI trading at $0.999, and swap it for 1 USDC worth $1.)

In the last year, we’ve seen declining usage with collateral value trending down. This is caused by a decrease in the demand for leverage and relatively low (vs risk free rate) rates when it comes to yield farming opportunities

As a result, Maker has created an enhanced DAI savings rate (EDSR), pushing the APY up to 8% on DAI

Note - the 8% is only the case if the utilization of the EDSR is below 20%. Anything over results in the rate being pushed down

And yes, DAI is operating at a loss here – they’ve recently put up another proposal to lower that rate down to 5%, which would be much more sustainable

The Real world asset (RWA) has popped up recently, and Maker has been taking full advantage of the rising US treasury rates

As a result, it’s been a huge contributor to Maker’s recent run up to a 150MM annualized revenue run rate (RWA accounting for 60% of that)

Maker also has plans to create subDAOs which will operate as subsidiaries – the goal is to distribute governance further downstream as well as experimenting with different parameters, collateral token types (at a smaller scale)

GHO (Aave’s stablecoin)

GHO is the native stablecoin - GHO is minted against the asset supplied to Aave (in more detail)

To bootstrap and incentivize usage, rates are currently set at 1.5% – with interest accruing to the Aave DAO treasury

The goal for Aave is to provide a native portal to distributed GHO trustlessly across networks – solving the fragmented liquidity problem

How does Aave maintain GHO’s peg?

Aave is still in the works of implementing all of this

They’ll have a bucket of assets that you can swap for GHO at a 1 USD rate

They will also implement dynamic interest rates (lower rates when price is > $1, and higher rates when price is < $1) to incentivize the right borrow/lend behavior

These ideas are still being fleshed out

What is the impact on Aave’s token?

Currently, the bulk of Aave’s revenue comes from interest with a small boost from liquidiations and flash loans

For popular stables (USDC, USDT) about 10% of the borrowing rate is retained by Aave

With GHO, they would raintian 100% – which they can then pass on the savings to users via a lower borrow rate

At 18MM GHO outstanding (currently) this generates about 250K in annual revenue

If GHO outstanding supply even reaches 10% of Aave’s borrow business (2B), it would double Aave’s revenue – its clear a self issued stable for borrow/lend protocols are very lucrative

Curve’s crvUSD

The mechanism for crvUSD is very similar to DAI – you deposit a collateral and an mint crvUSD (in more detail)

One unique feature that crvUSD provides is “soft” liquidations

A soft liquidation occurs by creating a LP with liquidity bins when a threshold LTV is reached

This creates “incremental” liquidiations which is beneficial as it you remove the risk of liquidity cascades and the problems that ocme with it (gas spike, potential oracle issues, etc) – allowing CRV to take on the risk in more manageable chunks

As a result, it also allows CRV to take higher LTV loans on the CDPs than it would otherwise, increasing capital efficiency

crvUSD has already been a huge source of revenue – from the loan interest and pegkeeper (Crv has a mechanism to manage when crvUSD > $1 and when its < $1) they’ve earned 400k to date (launched in May ‘23)

At 500M crvUSD outstanding and loan interest at 2.5%, this would double CRV’s current revenue (13MM annually) – after 5 months, it’s already at 80MM+ circulating supply

Frax

Frax is the 7th largest stable, with a mcap of 670M – there was a big decline post UST (Terra USD) collapse due the association of also being an algorithmic stablecoin

Here is a much more detailed write-up on Frax

However, unlike UST Frax doesn’t operate as an algorithmic stable – it is partially backed by collateral as well as the protocol’s native governance token FXS

Most recently, Frax actually passed a proposal to transition into being a fully collateralized stablecoin

More recently, Frax has been directing all profits towards collateralizing the stablecoin to further accelerate this process

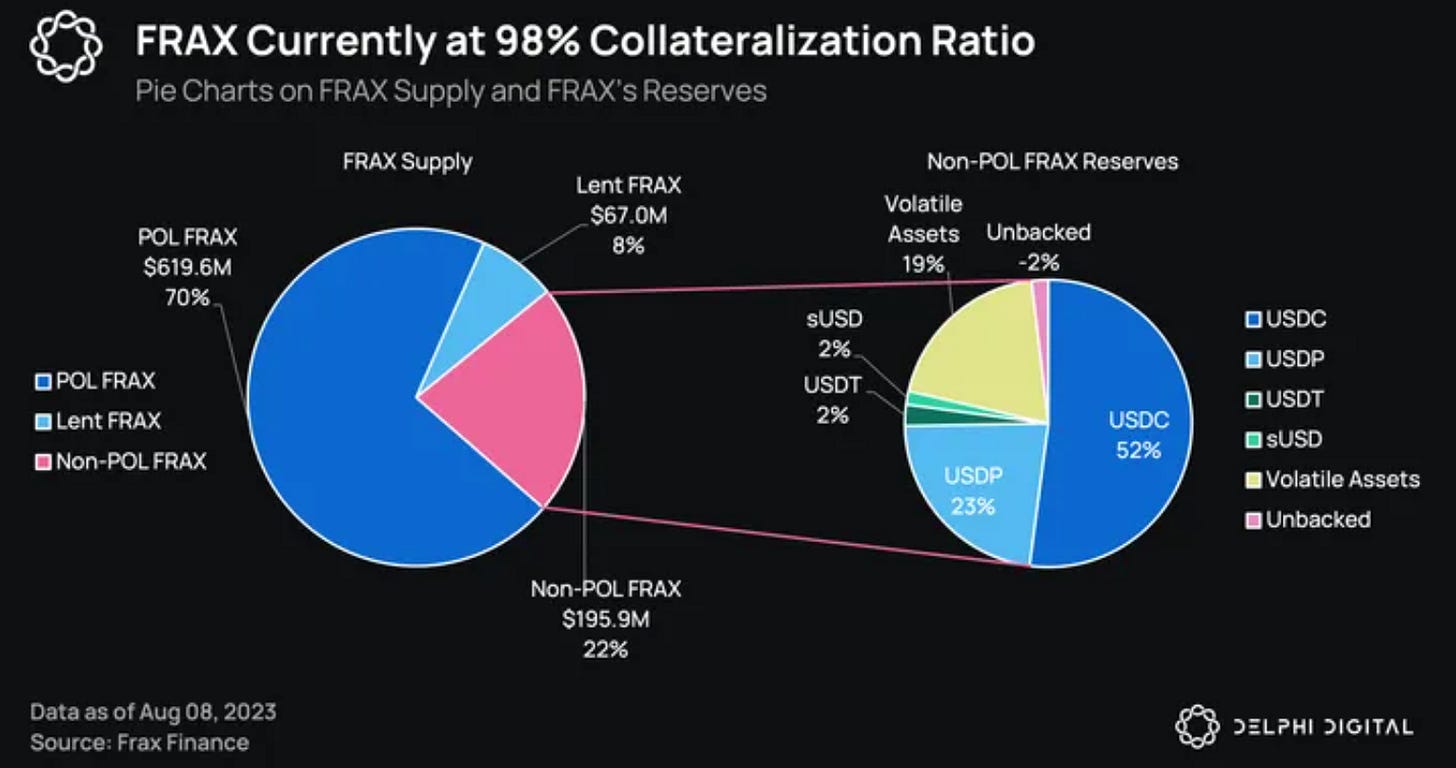

So where are we in the path of Frax becoming fully collateralized? If we take a closer look at the FRAX supply, 78% is protocol owned liquidity / loaned

This 78% either has an implicit peg by being part of liquidity pool OR it is over collateralized (created by lending against collateral

Of the 22% that isn’t protocol owned, we can see the collateral shortfall amounts to about 3.7MM which gives us a collateral ratio of 98%

Given that the annual Frax protocol run rate is about 20M (between ETH staking, lending, automated market operations (AMO) / protocol owned liquidity (PoL) fees) –- with the vast majority coming from AMO / POL

You can read more detail about how FRAX AMO / PoL works here

FRAX is the stablecoin, FXS is its native governance token

FXS also has a buy back system on FXS – effectively establishing a floor

Frax buys 1MM of FXS when price is below $5, and additional 1MM if it falls below $4

These purchases are spread over 30 days which effectively set a perceived floor for FXS

Repurchased FXS is either burned or added to the treasury

Frax V3 to be rolled out soon, lessening dep on USDC and Frax holders can soon access US T-bills (RWA)

Ethena

Ethena provides a very interesting model where a delta neutral position is opened

The mechanism works like so – hold stEH (long) and open short ETH perp position

This generates yield via stake ETH and potential positive funding from the short perp

You can then mint eUSD against the delta neutral position

While it sounds interesting, I’m wondering 1) how the yield and funding from the delta neutral position can be used to maintain peg stability, 2) how to minimize reliance on centralized exchanges (short perp) and 3) what the solution is during longer periods of backwardation + negative funding

Dinero

Dinero is a stablecoin built on the premise of providing an RPC service for its users

Users can stake ETH to be used for Dinero’s validators and then mint stablecoins against it

The goal is to allow users to pay gas in its native stablecoin

It further plans on allowing users to submit private txns and creating a separate market for MEV / payment for order flow

Lybra

Lybra is one of the leading LSDfi protocols that’s also created a CDP stablecoin (eUSD) backed by stETH – eth staking emissions yield is passed to stablecoin holders

Lybra v2 is launching which shall expand the collateral list to other LSTs + introduce flash loans

Dyad

Dyad is another stablecoin that involves a collateral pool – the unique characteristic is that you can choose how long to “lock” your collateral

The longer you lock your collateral, the higher LTV threshold you can have aka the more stables you can mint

During liquidation, your debt and collateral is transferred to the active participants in the pool

The pool benefits since this is essentially them purchasing your collateral at a discount

PayPal USD

Issued by Paxos and deployed on ETH – around 45MM PYUSD circulating

PayPal is not charging for conversions between PYUSD <> USD

PYUSD is actually “safer” than the USD floating around on PayPal – this is because there are more strict guidelines on the quality of the underlying assets

100% of the assets behind PYUSD are deposited into “cash and cash equivalents” – things like short term US treasuries, reverse repo, and commercial bank deposits

However, the regular PayPal dollars (36B outstanding) is invested in riskier assets – only 11B (of the 36) are in “cash & cash equivalents” and another 17B are in “available for sale debt securities” – these have default risk and are characterized by longer terms to maturity which both increase the price volatility

Paypal’s goal here is to avoid the hefty 1.5-3.5% fees that come with credit cards transactions

Gnosis Pay

Gnosis Pay (same parent company as Gnosis Safe) is an L2 built on a fork of Polygon’s zkEVM

The goal is to create “spending accounts” that will be interoperable with banks, debit payments with Visa and Mastercard and some other alternative, traditional payment methods

You get an IBAN (international bank account number) with every Gnosis Safe

If a user wants to receive funds from another person’s bank account on-chain, they need not get them set up with crypto wallets and transfer on-chain, they can do a standard bank transfer with the Safe’s dedicated IBAN and receive the funds directly on-chain

Here’s my Twitter — feel free to reach out if you have any questions, want to discuss the article or just chat!

i read. keep em coming.

i love crypto more though.