Jay’s Takeaways – Coinbase: From Sleeping Giant To Industry Leader

From Delphi Digital

Link the article — also big shout out to Delphi and Anil for making this possible!

Overview

Coinbase has been around since Bitcoin was trading at $6.65 in 2012. They’ve come a long way since then – now a public company. So, where do we go from here?

Delphi’s report covers 3 new pillars that could potentially provide a fairly big boost to Coinbase’s business moving forward. Afterwards, he covers Wall Street’s expectations. I’ll briefly summarize:

Pillar 1: Coinbase goes Global

Pillar 2: Spot BTC ETF Custody

Pillar 3: BASE

Wall Street Expectations

Coinbase goes global

In May ‘23, Coinbase opened a derivatives platform for institutional clients outside the US

This platform is API only (no UI) but it is clear there is product market fit here – they’ve done 4B in 30D volume with only 4 contracts listed

Given the animosity of the SEC, this provides a regulatory hedge and geographical diversification (90% of COIN revenue in ‘22 came from the US”

“We believe Coinbase sees the looming opportunities in the global crypto futures market and is positioning itself to capitalize a market that's been hollowed out (FTX) over the last 12-18 months”

For those of us that haven’t looked into Binance /OKX/ Bybit, it is insane how much volume their futures and derivatives platforms do on an annualized basis

Binance, Bybit and OKX did 14.6T, 3.1T and 4.3T respectively trading volumes from Sep ‘22 - Sep ‘23 – for every BPS of fee captured, that would be 1.5B, 310M, 430M (!!!)

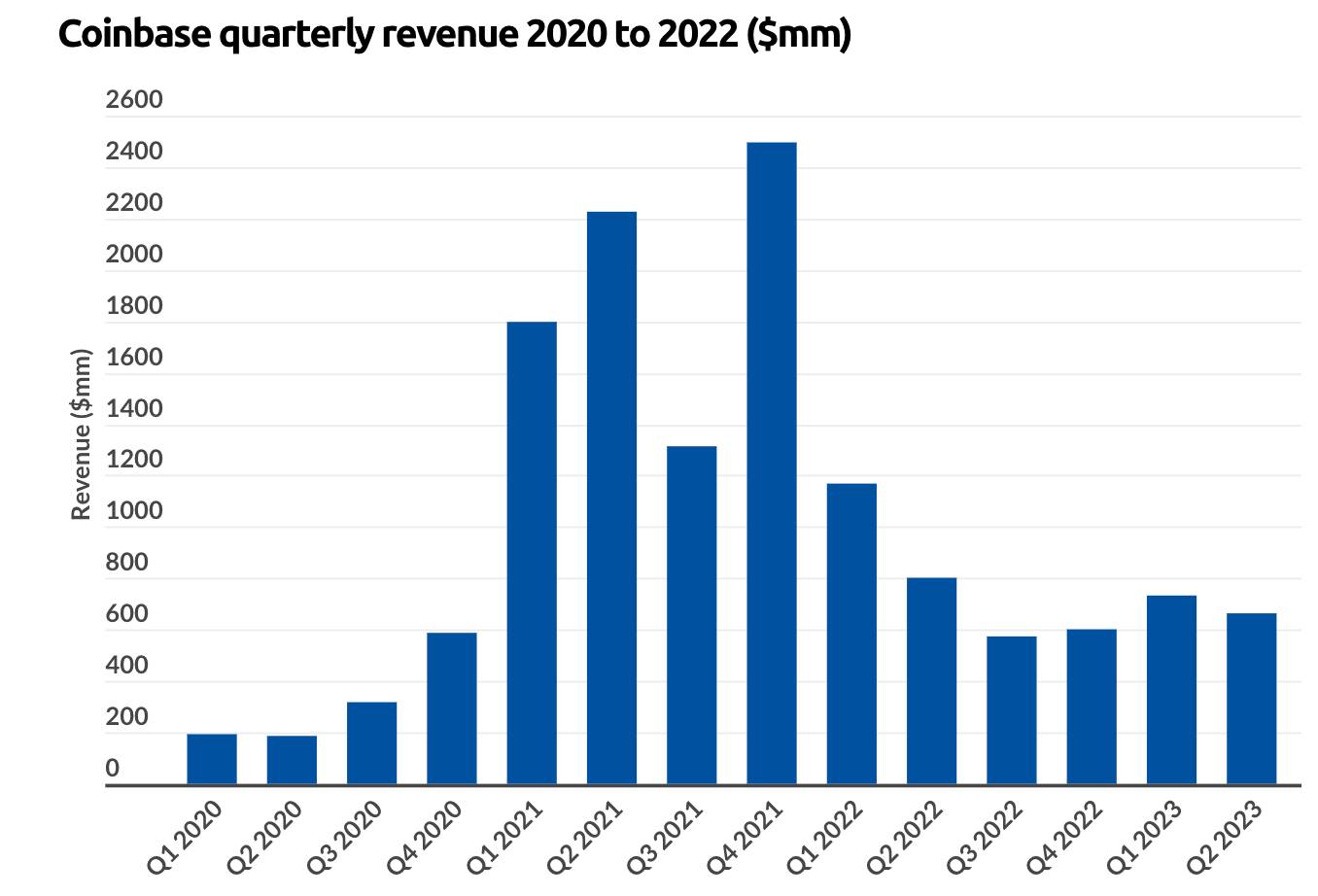

Considering, Coinbase annual rev was 3.2B in ‘22, the futures platform represents a significant revenue opportunity

Spot BTC ETF Custody

Coinbase did about 80M in revenue in custody on 40-50B of assets

Recently, a number of asset managers have filed for spot BTC ETFs – notably they have all listed Coinbase as the custodian

At this point, a spot BTC ETF approval seems like a matter of “when approval” and no longer a question of “if approval”

Coinbase benefits directly in two ways here

The obvious is that they will receive inflows of BTC to custody

The second is that the spot BTC ETF trading will also increase spot BTC trading volumes on Coinbase itself (BTC-USD)

Indirectly, this opens the floodgates for the spot ETH ETF. Given the Shanghai (staking withdrawal) patch has rolled out and been derisked, a staking ETF may also be in the picture

It’s hard to have an accurate measure of the impact to Coinbase top line revenue considering the above, but it’s definitely positive and brings many intangibles (legitimacy of crypto, Coinbase brand)

BASE

Base is killing it – out of all the L2s, Base is by far the fastest to 100K active addresses

There are a ton of comparisons between Base and Binance Smart Chain (for good reason)

So how does Base’s business model work currently?

The simple model is:

Txn fees (revenue) - Expenses (L1 settlement) is the profit that Coinbase makes off Base

Since Base mainnet launched ~6 weeks ago (and it’s revenue was skewed higher due to a bug in Metamask – default priority fees were set higher than they should’ve), Delphi models out Base’s revenue based off historical L2 (Arbitrum + Optimism) data

This results in 9.5MM, 30MM, 69MM, and 1.6B profits in each of the cases

None of these (aside from the limit which is very unlikely) are directly material to Coinbase’s top line revenue

However, given Coinbase’s brand value, Base provides a hedge against other d’apps cannibalizing Coinbase – “let’s cause such a stir in EVM-land that every L2 and ‘Ethereum-aligned’ project decides it’s easier to partner with us than fight us”

As Base matures, Coinbase will have the know-how and infrastructure to run other L2 sequencers – both pushing the decentralization forward as well as scaling out the sequencer revenue

Also, while a $BASE token may not be in the immediate, it’s an interesting thought experiment to consider what valuation it could ultimately command - it also pushes forward the narrative of decentralized governance

Brian Armstrong said it best: Base helps Coinbase by “growing the pie.” If it works, Base will bring more trading fees, subscriptions, and sequencer profits. Base also helps protect Coinbase from its only true threat: decentralization.

Wall Street Expectations

Wall St expects Coinbase revenue to grow 5.5% year over year from now to ‘27 (lol)

They expect retail trading volume take rate to compress heavily and overall trading revenue to decline materially from now until ‘27

Wall St expects $COIN to trade at $88, one year from now as a result of these expectations

Wall street equity research has molded Coinbase in the model of a big bank, as Michael Rinko put it “gather as many deposits as possible and earn interest on them” – to be fair, Coinbase has done this with USDC and some other staking/interest products which has provided a great hedge during the risk off + rising rates environment

My take: all of these pillars mentioned are overlooked by 99.99% of Wall Street.

I don’t think Wall st understands the cyclicality in crypto and how reflexive Coinbase’s business is with respect to the total market cap of crypto

Once the inevitable rate cuts start, risk assets + staking income becomes much more attractive which will provide another huge boost to the reflexivity within this space

Here’s my Twitter — feel free to reach out if you have any questions, want to discuss the article or just chat!

It's a bit obsure, but on the BTC ETF point, coinbase had $130bn Assets under custody in 2021 (can use reports to guesstimate how much now then use division revenues to guess the custody fee.