Arthur Hayes -- The Periphery

Another one

Arthur shares his view (original article) on the bear steepener and the Hamas terrorist attacks – specifically on how these will impact markets. I break down his essay into a summary of 4 parts:

Rate Pause

Bear Steepener Death Spiral

Hamas Attack

America’s conundrum

Rate Pause

In ‘22, the FED took the strategy of raising rates + quantitative tightening to reduce inflation

The FED said that once inflation is low enough (very ambiguous) they would stop

Recently in the Sept Fed meeting, Powell said that the FED is close to finishing rate hikes

Additionally, we saw longer term rates rise. Members of the FED responded to this as a signal that the Fed no longer needed to raise rates

As a result the longer term bond market saw a large sell-off (relative to the shorter term bonds) resulting in a “bear steepener”

A bear steepener is when the longer term rates rise faster than the short term

Why does this happening?

Inflation is still here. “The manipulated US gov inflation stat, core CPI is still more than double the Fed’s target of 2%”

If the FED announces it is pausing its fight against inflation, owning long duration bonds presents more risk around its value decaying in real terms

Historically, a bear steepener rarely happens. What usually happens is the FED continues raising rates and tightening until something breaks

Once a catastrophe happens, the Fed aggressively cuts short term rates, un-inverting the yield curve. This is a “bull steepener”

Bear Steepener Death Spiral

So why is a bear steepener so dangerous?

Banks make money based off the spread between the deposit rate they pay and the loan rate that they issue out

A simple example is a mortgage. A 30Y fixed rate mortgage that the bank issues out will carry plenty of risks (simplified)

If interest rates go up after the mortgage fixed rate is locked, banks will suffer a unrealized loss on their balance sheet

You can hedge interest risk by going short (taking a loan). But then the question of “what duration should the loan be?” comes into play

If the duration is too long, and the mortgage is prepaid, the bank is now exposed

If the duration is too short, and rates go up, you re-run into interest rate risk

Keep in mind, the past 15 years (up until ‘22), interest rates have basically been trending down aggressively and in the last few years were at rock bottom

As a result, Arthur thinks that the vast majority of banks long term loans are not hedged properly

Long duration bond values also decay exponentially with an increase in rates (e.g. roughly, a 10Y loan will decrease 10% in value for a 1% increase in rates)

More concretely, after the GFC in 2008, rates were kept near zero and quantitative easing (central banks printing and buying long bonds to suppress yields)

As a result, there was demand for higher yield, and a lot of banks’ fixed income desks sold exotic interest rate products to fulfill this gap

To simplify it, these banks are now short volatility wrt to the long term rates

As volatility in long term rates go up, these banks will suffer losses

In order to hedge this, they would sell long term bonds

And now have a nasty bear steepener death spiral

As volatility goes up, long term bonds need to be sold to hedge

Selling long term bonds increases the volatility

MOVE measures the bond volatility and you can see above that it is increasing in correlation with the spread between short vs. long term interest rates

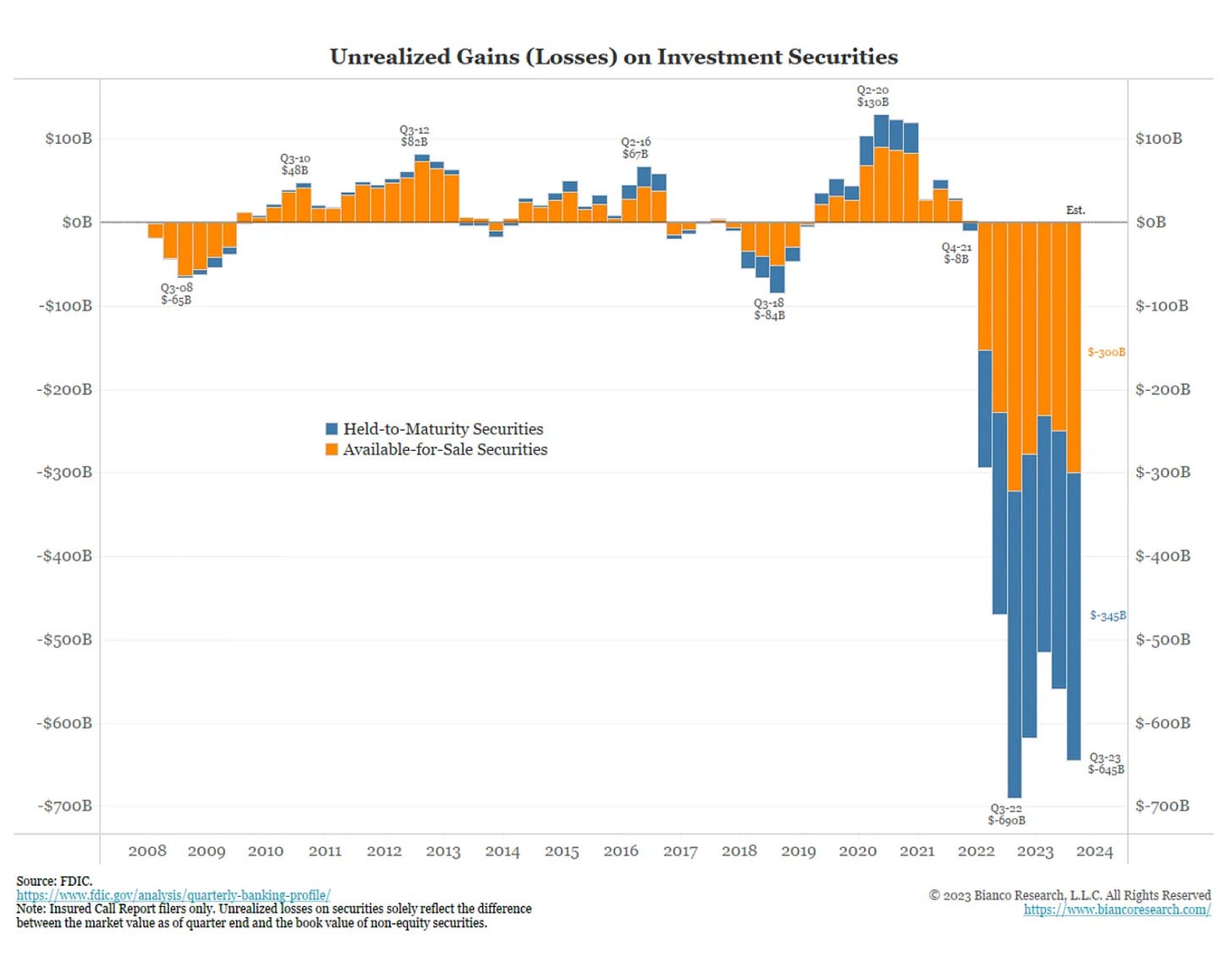

In addition to this, the US banking system suffered a crisis back in Mar ‘23. This issue still exists and we can see that US banking system has another 700B in unrealized losses on US treasuries

What the market hasn’t come to consensus on is that the entire balance sheet of the US bank is government guaranteed

Government guarantee means more $$$ printing (and as a result, increased inflation)

Hamas Attack

After the Hamas terrorist attack, the market reaction was:

Treasuries rallied (yields fell), gold moved lower, oil slightly higher

The immediate narrative was that ppl wanted US debt as a flight to safety

The muted reaction of oil showed that the market didn’t believe the conflict would escalated

Oil prices rose slightly - which showed that the market didn’t think this conflict would escalated (oil prices go way up during a full blown conflict)

Shortly, the Israeli PM issues an aggressive response “Every Hamas terrorist is a dead man” – escalating the war

The complication here is that a number of Arab countries (pro Palestine) surround Israel

So if Israel decides to strike back, how does America react here? America needs to make a decision on whether to outright support Israel or not

Russia and China also have complex relationships with the middle east. If America steps in (or if they don’t), what do they do now?

Remember, the US spent 10T on the Afghan, Iran, Syria conflicts in the early 2000s. Biden has stated that he backs Israel. So how far is he willing to go here?

America’s Conundrum

Remember, the most important thing in politics is re-election

Hamas was terrible for people, but it is bringing people together in stronger support of Bibi politically. As a result, there is pressure on Bibi to respond in a favorable way

Israel’s response has already caused lots of innocent Palestinian civilians to be killed

Now the ball is in Biden’s court. Is this the sort of behavior that America will support?

Biden is stuck here, there is no good option.

If he doesn’t support, it will be a sign of weakness of America

If he does, it can be taken the wrong way by Russia’s ally Syria (and will force Russia to react)

After the military response escalated and America stayed silent, the US treasury market continued selling off. Its clear that the market is pricing in the future cost of military support to Israel

In either case, if America pours resources into funding the war, that increases net demand which spikes inflation

Additionally, you do not want to own long term debt from a sovereign nation that may be involved in multiple state level conflicts (Ukraine, Israel)

Conclusion

This is starting to look more and more like “buy hard assets” trigger for Arthur. It’s not the set up he expected, but its one that has a pretty inevitable outcome

As Arthur says “the perfect set up is usually staring you right in the face, and you are too preoccupied with the past to notice” — Arthur is starting small but he is bidding