Expression -- Arthur Hayes

Fed Pivot, ETF, and some areas of crypto that don't make sense

Arthur talks briefly about the Fed Pivot, some aspects of crypto that he is not so enthusiastic on, and the Bitcoin ETF

Jay Powell and the Fed Pivot

The December FOMC was the explicit event where the Fed decided to pivot – he indicated that the Fed anticipates 3 rate cuts the next year

Just 2 weeks before, Powell said it was “too soon to speculate on rate cuts”

Arthur thinks this is primarily motivated around re-election – a politician’s number 1 goal is to be re-elected and the most important thing to do is to get the economy in order

Expect financial assets to moon, up until either a recession or significant inflation returns

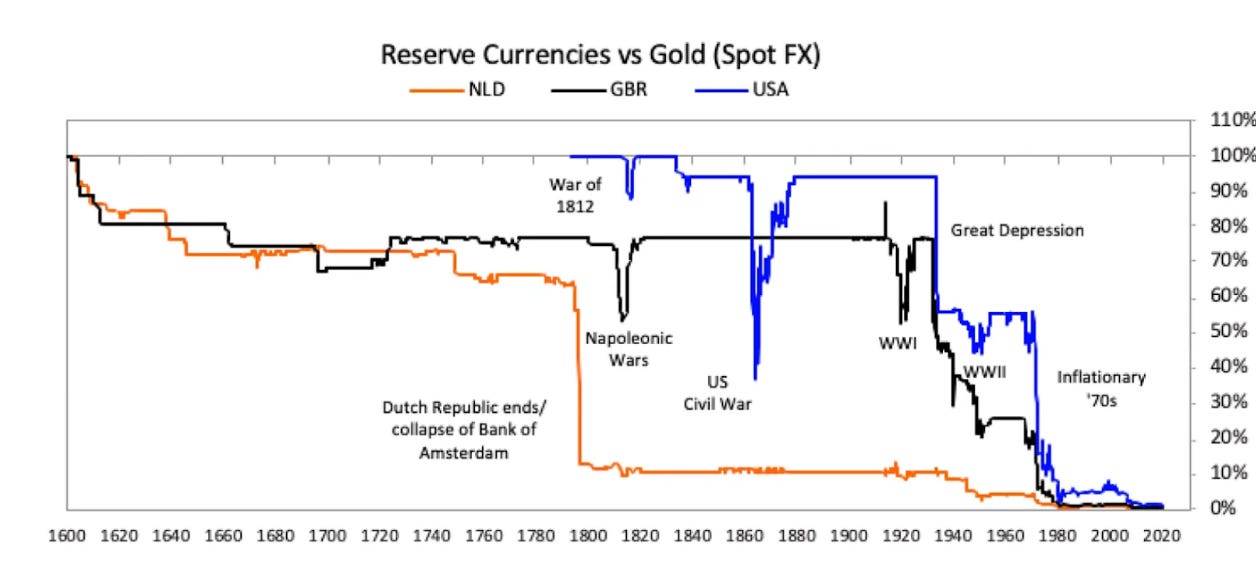

Other nations benefit - a weakening dollar is a situation where everyone wins

Value Traps in Crypto

Categories within crypto that make no sense to Arthur

Permissioned DeFi

What the fuck is a centralized decentralized financial network?

Arthur thinks this framing is to allow institutions restricted from regular to DeFi to line up retail that wants to try out a new product. Why? Institutions don’t wanna trade against other institutions

“After the hype fades, these permissionsed DeFi markets will just be a circle jerk of high frequency trading shops sitting on the bid and ask waiting for the other to cross the spread and get fucked”

RWA

RWA projects take things like property, securities, etc. and create an SPV, offer fractionalized ownership via tokenization

Why pay a premium for decentralization when a centralization option already exists?

RWA, particularly real estate makes no sense. Specifically:

Owning a fraction of a house provides no utility (you can’t live in it)

Houses are also unique.. how do you capture this in fractionalized forms

Lastly, REITs exist. Why not use those instead?

RWA Debt

Stablecoins like USDC / USDT take your $ and buy debt with it. But they don’t share it with you. Yield bearing stables are the version that does share the yield

Using and holding these aren’t bad, but why hold the project’s governance token?

Think of the project’s governance token as a distant proxy bet against rates. “If rates stay above zero, project will accrue profit, maybe they pass it to token holders. If rates decline, project will lose money”

You can just long / short a bond ETF (and apply leverage) if you really want to bet on rates directionally

The BTC ETF

If ETFs are too successful they will destroy BTC. Why?

ETF providers take too much of BTC supply means coins wont move around within the network

“The end result is miners turn off their machines as they can no longer pay for the energy required”

Its beautiful in that if BTC becomes another state controlled asset, it then dies

Election Year

2024 is one of the years with the highest number of national elections

For politicians looking to get elected, they need to give handouts to the people

For the rich, Give asset holders loose financial conditions -> print money

For the poor, give them handouts to cover food and rent

For middle class give them democracy, tell them to pay taxes, bend them over and be glad they get a vote

“The votes from those that benefit from currency debasement will outweigh hte votes from those who suffer

Currency debasement is the rule and not the exception

And as always, Arthur’s solution is to bid Bitcoin

This post is sponsored by Aevo. Aevo is an options/perps DEX built on their own appchain, with one of the best options UX in DeFi - I use them myself to hedge my spot positions in a much more capital efficient manner. They are also super quick in listing the hottest pre launch tokens ($TIA, $BLAST, $PYTH) on their perp DEX

They’ve rebranded from ribbon finance and will be doing an airdrop soon. Use my this link to support me and save fees when you use Aevo

Great thread.