Ethereum and the innovator's dillema

Not looking so hot

So where does Ethereum go from here? I cover modular blockchains, database design, and quote GCR in an attempt to answer this question. For full disclosure, I am net long Ethereum.

The thesis behind the Innovator’s dilemma can be summarized as:

“Successful companies often fail to adapt to paradigm shifts, particularly when it comes to technological innovations. The reason being is that they focus and over allocate to aspects that have made their product successful as opposed to experimenting with newer, unfamiliar ideas”.

In the world of blockchains and smart contracts, we’ve made considerable progress over the last several years. Now, the million dollar, or 250 billion dollar, question is: what is the fate of Ethereum?

Through this writing, I will argue that: Ethereum has topped both in terms of 1) valuation relative to all all crypto assets (ETH.D) and 2) relative use and adoption.

I will start by exploring the concept of modular blockchains, drawing a comparison to traditional database design principles, and then tying it all back to Ethereum and its future.

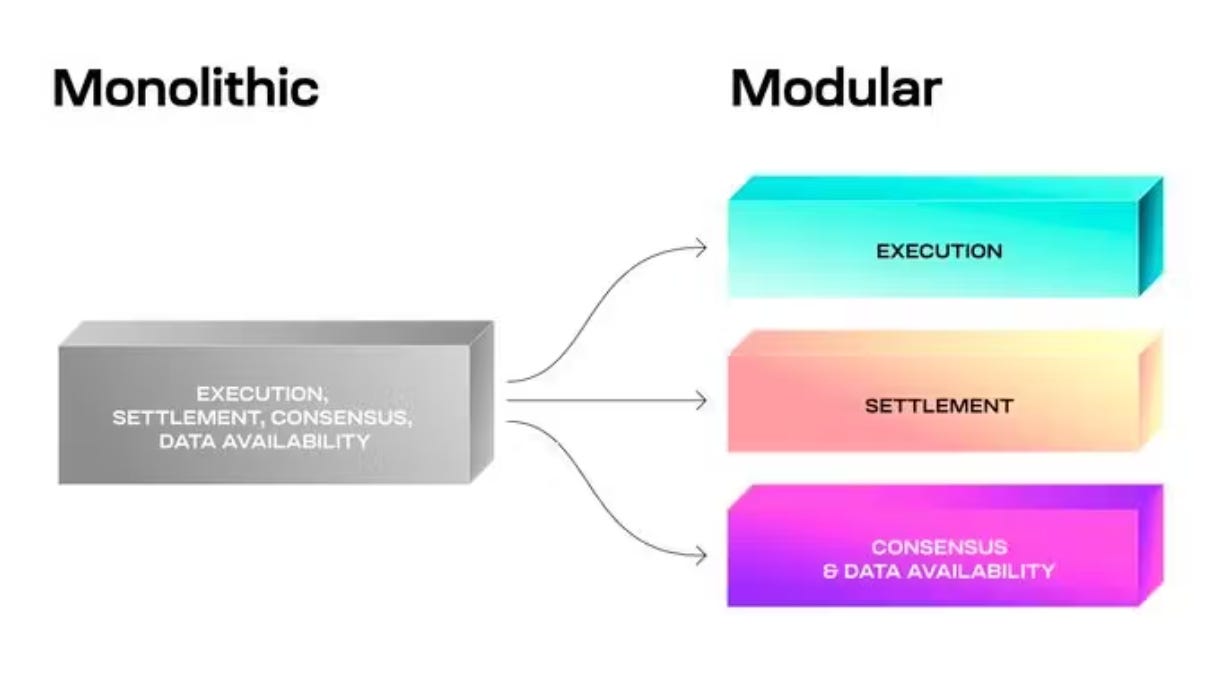

Modular blockchains

There’s now a much more principled way of thinking about what makes for a well functioning blockchain and a logical approach to decouple (and scale) the core components. This is the monolithic vs. modular debate.

The core idea behind the modularity when it comes to blockchains is that there are four fundamental functions:

Execution

Determining the state “after” a transaction(s). If I send tokens to a given wallet, the execution layer determines the relevant balances before and after

Settlement

Determines whether the transactions submitted are “legitimate”. After sending tokens, the balances are xyz - settlement determines whether xyz is correct or not

Consensus

Determines the final state (after a bundle of transactions). This layer determines 1) what is the correct order given a series of transactions and 2) after processing these transactions, what is the final state?

Data Availability

For any of the above 3 functions to exist, there needs to be a prior state and an ending state. The function of DA is to provide the state to the execution layer, and update the state based off consensus finality

As with any engineering problem, the concept of a “perfect” blockchain only makes sense if there is a well defined use case. The existence of this framework allows for more specialized blockchain design - a blockchain built for high throughput gaming will have very different needs than one that aims to be a global, decentralized ledger.

This framework of thinking reminds me a lot of the principles around database design, particularly around the SQL vs. noSQL debate.

Database Design

Databases have been around for several decades longer than blockchain. The consensus when it comes to its design is that there is no perfect database. As with most engineering problems, it all comes down to trade-offs.

A framework for building a scalable database comes back to "what is the use case?”. Before coming to a decision, some questions I would ask are:

What is the rough ratio of reads to writes? On an app like Telegram or Slack, reads vs. writes will be similar in magnitude whereas on Twitter, reads will be orders of magnitude higher than writes

In distributed systems, there is the notion of consistency vs availability. In other words this can be rephrased as: do we care more about inaccurate data vs. our app’s downtime? Again, this depends. For a fintech app, consistency (accurate data) matters much more

How important is stale vs. fresh data? How does this relate to the read vs write loads? Does our database allow us to execute a strategy to deal with concurrent writes and reads? For example, my wife draws out cash from my bank, right as I swipe my debit card - how can we prevent the classic double spend issue?

What are the read patterns like? Do you need flexibility in how the data is accessed or is it generally pre-defined? Are there a lot of joins that you do across different datasets?

And even beyond technical considerations, it is important to understand:

How many engineers are fluent in this technology? How many engineers actually want to build with this technology?

Is there a way to get active support in case we want to fork the underlying code and tweak it?

Ethereum’s Future

Now to bring this full circle - the perfect blockchain doesn’t exist. Good engineering is all about trade-offs, there is no one size fits all. So how did Ethereum become such a “dominant” platform? Why is Ethereum priced as if it is the perfect blockchain? And finally, where does Ethereum go from here?

How did Ethereum become such a “dominant" platform?

Four years ago, Ethereum was the go-to smart contract platform to build on. It had great developer tooling (relative to everything else) with Hardhat, CryptoZombies and so on. In addition, there was a dedicated user base and the chain and token were “decentralized”. Back then, centralized blockchains were much more likely to be a grift. ETH the asset was also much cheaper, which meant gas fees were too.

Fast forward to today, developers have many more smart contract platforms to build on, each with a unique set of trade-offs. And although there are still grifts, relatively to where we were 4 years ago, it has significantly decreased as more talent and capital enter this space.

The same things that made Ethereum successful in the past are why it will fail moving forward. There was a period where Ethereum was the only viable smart contract platform for developers to build on. Legitimate use cases (DeFi, NFTs) gave ETH a huge headstart. But during this phase, the focus shifted towards value accrual (ultra sound money) and competing with Bitcoin to be the de facto internet native store of value (the flippening).

The desire to be both a smart contract platform and decentralized “ultrasound money” adds significant friction (higher gas costs, congested network) for the marginal user and developer. As Confucius (and GCR) says He who chases two rabbits catches neither.

Where does Ethereum go from here?

Users will go where apps exist and where the costs make sense. However, app developers tend to be more deliberate and long term focused as there is much more overhead relative to the users themselves. Developers will build on platforms where there is the potential for their apps to grow and scale longer term.

Now look at Ethereum - it averages 15-20 TPS, and gas fees often spike to $200 for a swap. There are very clear restrictions on what can be built on Ethereum and these are apps that require very minimal interactions. For example, a borrow lend protocol is a great app on Ethereum since I may interact with it a couple of times a year.

But if I was an app developer that was looking to build something with the intention of scaling it to 100K or 1M users and with much higher usage patterns, there is no world in which that can be feasibly built on Ethereum.

And this is becoming much more apparent as viable alternatives pop up left and right.

FriendTech was built on Base L2

Pacman and the Blur team are looking to spin up their own L2

DYDX utilizes their own specific app-chain

The modular blockchain framework provides a set of trade-offs that blockchains can pick and choose from. We are now in a state where blockchain infrastructure that supports the points along the trade-offs’ curve are starting to come into existence.

Lastly incentives, incentives, incentives.

As Charlie Munger has always said “show me the incentives and I will show you the outcome”. The incentive structure that exists to build on Ethereum is inferior when it comes to the other existing blockchains. Venture firms and new L1 teams have a vested interest in building out a robust, thriving ecosystem. As a investor, I would think why have my teams build on Ethereum when the token is so distributed and the ecosystem is already so crowded? Why not facilitate app development on a blockchain that I have a vested interest in where L1 valuation is much lower?

ETH is no longer on the efficient frontier when it comes to blockchain design. There are superior smart contract platform choices regardless of where you want to be on the tradeoffs curve, and the incentive structure is set up to work against them. Unless there is a fundamental change around how Ethereum operates both as a community and as an organization, their relative dominance with respect to valuation and usage has peaked.

.

Spoken like a true Solana maxi. You perfectly understand the nuances with database engineering and trade offs made for every engineering decision. Solana is making the wrong trade offs and will pay for it eventually.

Great take.