Dust on Crust pt 2 -- Arthur Hayes

Tether vs Ethena

Arthur thinks that Ethena will flip Tether as the largest stablecoin eventually.

He walks through why Tether has the best (but also the worst) business in crypto

Then provides a brief overview of Ethena, why he thinks it’ll flip Tether, its risks and a valuation model.

Here’s my summary:

If you want to try out Ethena and get those juicy yields, here's a ref link (helps me out too!)

Tether - the best and worst business in crypto

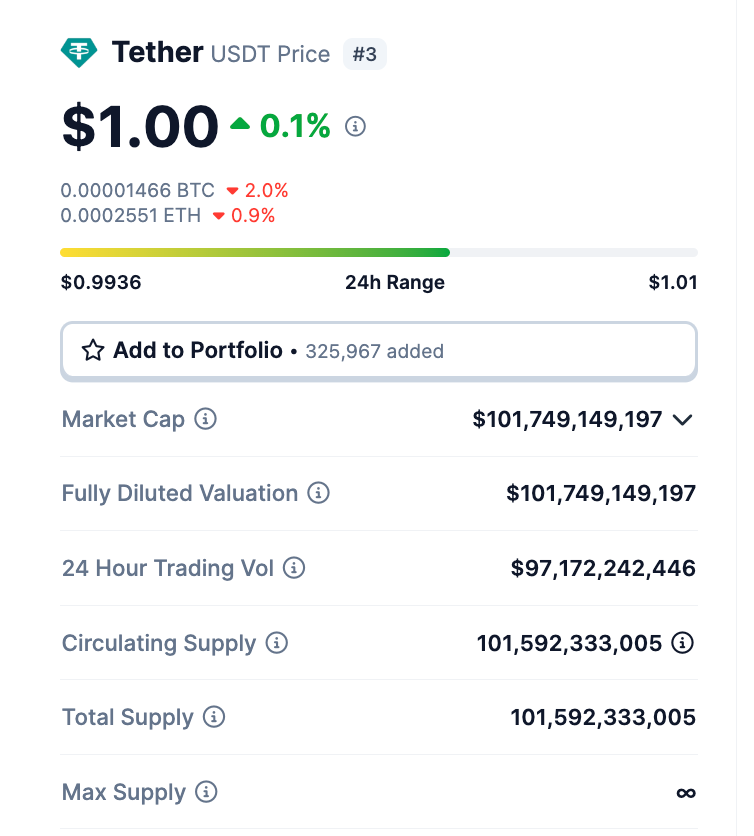

Tether is a stablecoin (USD denominated)

Customers deposit USD, and received USDT. It also includes the redemption process (burn USDT, receive USD)

The crux of Tether’s business is that it needs a Fed approved bank account

In order for Tether to move dollars around, especially across jurisdictions, it needs to get approval from the Fed

So if Tether doesn’t have a banking partner, it can’t function

Tether acts as a fully reserved bank (meaning the dollar deposits it gets are not loaned out). What does Tether then do with these dollars then?

Tether shoves them into money market funds and treasury bills

At this point it has nearly 81B invested into MMF and treasuries

Additionally, Tether pays 0% of the interest to customers

They have ABSOLUTELY printed over the last 18 months

Tether - too big to fail?

It is now a liability in the system (too big to fail?) – if it was a forced seller of its US debt, it could wreck the treasury market

So how would you off board Tether without knocking down the dominoes across the system?

Need to slowly sell off Tether’s US debt

Freeze Tether’s assets until the market is more capable of absorbing its assets

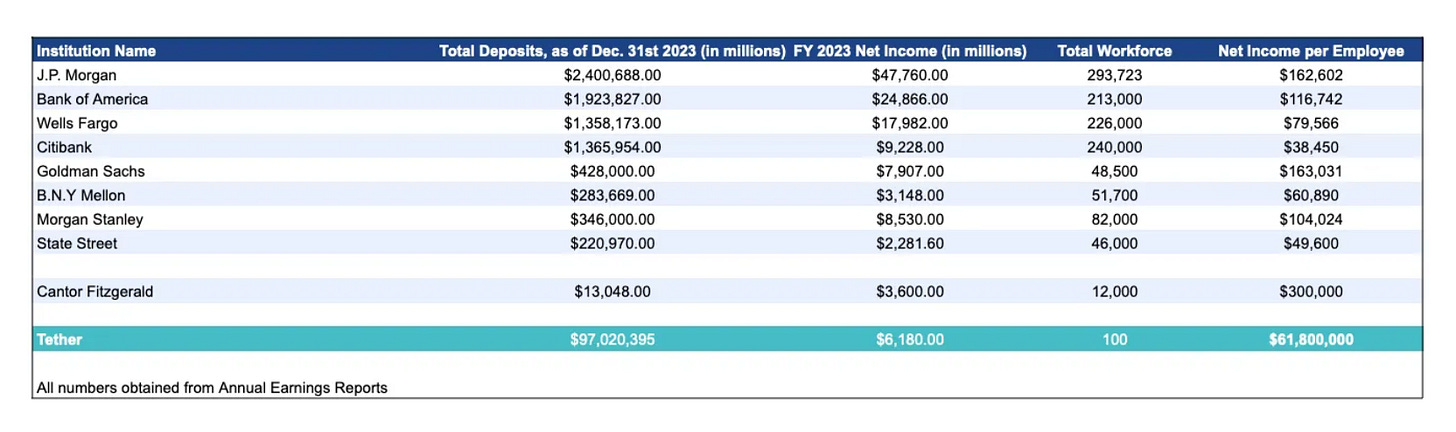

Tether clears 62M per employee, order of magnitudes larger than any of the existing US banks

US banks are certainly eyeing Tether’s business and also watching Circle’s IPO

These stablecoin businesses don’t have a strong moat - especially since they have a dependency on the US banking system

What is stopping JP morgan from trying to issue out their own stablecoin?

One other issue Tether has is an incentive/alignment one

Unclear whether banking partners have equity

They don’t have a gov token, so customers/users can’t share upside

Customers/users also don’t get to share in their interest income

Ethena - Overview, Luna?, Risks, Insurance Fund, Valuation

Overview

Ethena is a protocol that generates a synthetically backed fiat crypto dollar

It combines a spot staked ETH position + short ETH perp in equal size

Tether proved out product market fit for stablecoins and tee’d up the perfect opportunity for Ethena

Ethena addresses the 2 major problems Tether has

Holders of USDe can stake directly and earn the vast majority of interest

Incentives/alignment are set up perfectly

Major exchanges all invested in Ethena during early rounds (in aggregate they cover 90% of ETH OI)

A governance token will also exist so users can gain upside to Ethena

If USDe has such high yield why wouldn’t it trade at a premium to other stables?

There is an arb here - if USDe’s premium is high enough, you can mint USDe by depositing staked ETH into Ethena, than swap it out for stables

This puts downward pressure on USDe

Comparisons to Luna

UST was backed by Luna + some BTC

USDe is backed by staked ETH + short perps on various exchanges (no relationship to Ethena’s gov token)

Additionally ETH is deflationary (ultrasound money!) and USD is inflationary

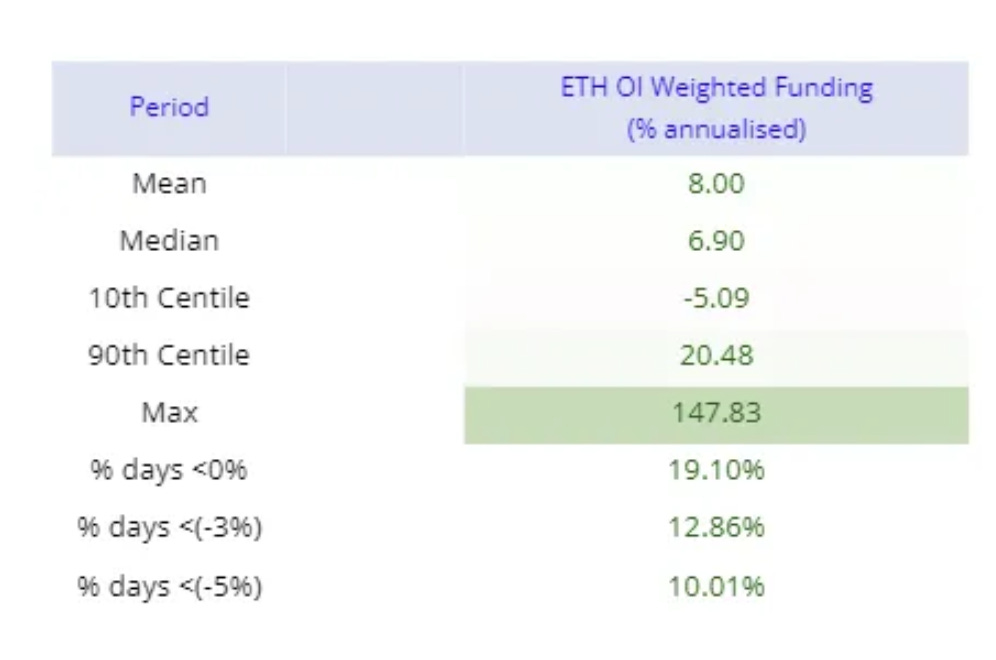

So in the long run, funding on ETH future derivatives will generally be positive (prem to spot)

UST and USDe are very very different

Risks and Limitations

Exchange/counterparty risk

Ethena isn’t decentralized and it isn’t trying to be

If exchanges run into problems, there will be an issue

Ethena tries to mitigate against exchange risk by placing funds on 3rd party custodians such as copper

Compare this to Tether - their CP risk is with TradFi banks vs. Ethena’s CP risks with CEXs and custodians

Relative to Tether, Ethena, incentives are more aligned. Many of the largest CEXs are investors (CEX derivatives trading is also a highly profitable business, why would they want to endanger that?)

ETH OI as a bottleneck (to flip Tether)

Total ETH OI is 8.5B on the exchanges that Ethena operates on (total ETH OI is 12B across all exchanges)

There is an additional 31B of OI on BTC contracts if/when they decide to onboard BTC

Arthur also hints at the potential of using staked SOL + short SOL perps

In aggregate, this is still smaller than Tether’s marketcap today. But if the total crypto marketcap goes to 10T…

LSD smart contract risk

This is if Lido’s smart contract has an issue

Prolonged net negative funding (staking yield + perp funding)

Smart contract risk

Ethena’s deposit vault is fairly simple and only approved participants can interact with it

Most of the complexity comes from a system that lives offchain

Insurance Fund

Ethena does have an insurance fund (currently 16M) that is there to bid USDe in case some of the risks actually play out

The fund is capitalized from Ethena’s fundraising + portion of yield generated by USDe that hasn’t been staked yet

In the long run, the insurance funds will be capitalized by a long term take rate on USDe yield

Valuing Ethena

Arthur assumes, long run:

20% of yield goes to Ethena treasury

4% yield on ETH staking

20% funding rate on perps

If these are the assumptions for revenue, what is the right multiple for an FDV calc? Arthur compares this against other protocols

Ethena’s $820 million of assets generated a 67% yield this week. Extrapolating that out for a year given a 50% sUSDe to USDe supply ratio, Ethena’s annualised revenue is ~$300 million. Using an Ondo like valuation leads to an FDV of $189 billion. Does this mean Ethena’s FDV will approach $200 billion at launch? No. But it does mean that the market will pay up big for future Ethena revenues.