Bitcoin Synergy

Everyone is underestimating

In the past several years, there’s been a lot of progress in education and awareness around Bitcoin. As Saylor likes to say:

Even though people are coming around to this, I think people are still underestimating the synergy that is going to come from:

The halvening

Saylor’s bid

Tether bid

Spot BTC ETF

BTC miners HODL strategy

Nation states/companies

The halvening

The halvening is going to cut supply in half. There is about ~900 BTC produced daily. In 6 months or so, this will be cut to ~450 daily.

Saylor’s bid

Saylor, on average, has been buying 4.68B worth of BTC since Aug 2020. This is 4.1M worth of buying pressure everyday

Tether’s bid

Tether earns ~1.5B (as of Q2 ‘23) from their reserves every quarter. They will be re-investing 15% of their net profit into BTC. With only 12 employees, it is safe to assume their net profit isn’t too far off from their revenue. With rates now 50 BPS higher since Q2, 150-200M BTC bid from Tether every quarter is a conservative estimate.

Additionally, as of Q3 ‘23, Tether holds 54998 BTC on their balance sheet.

Spot BTC ETF

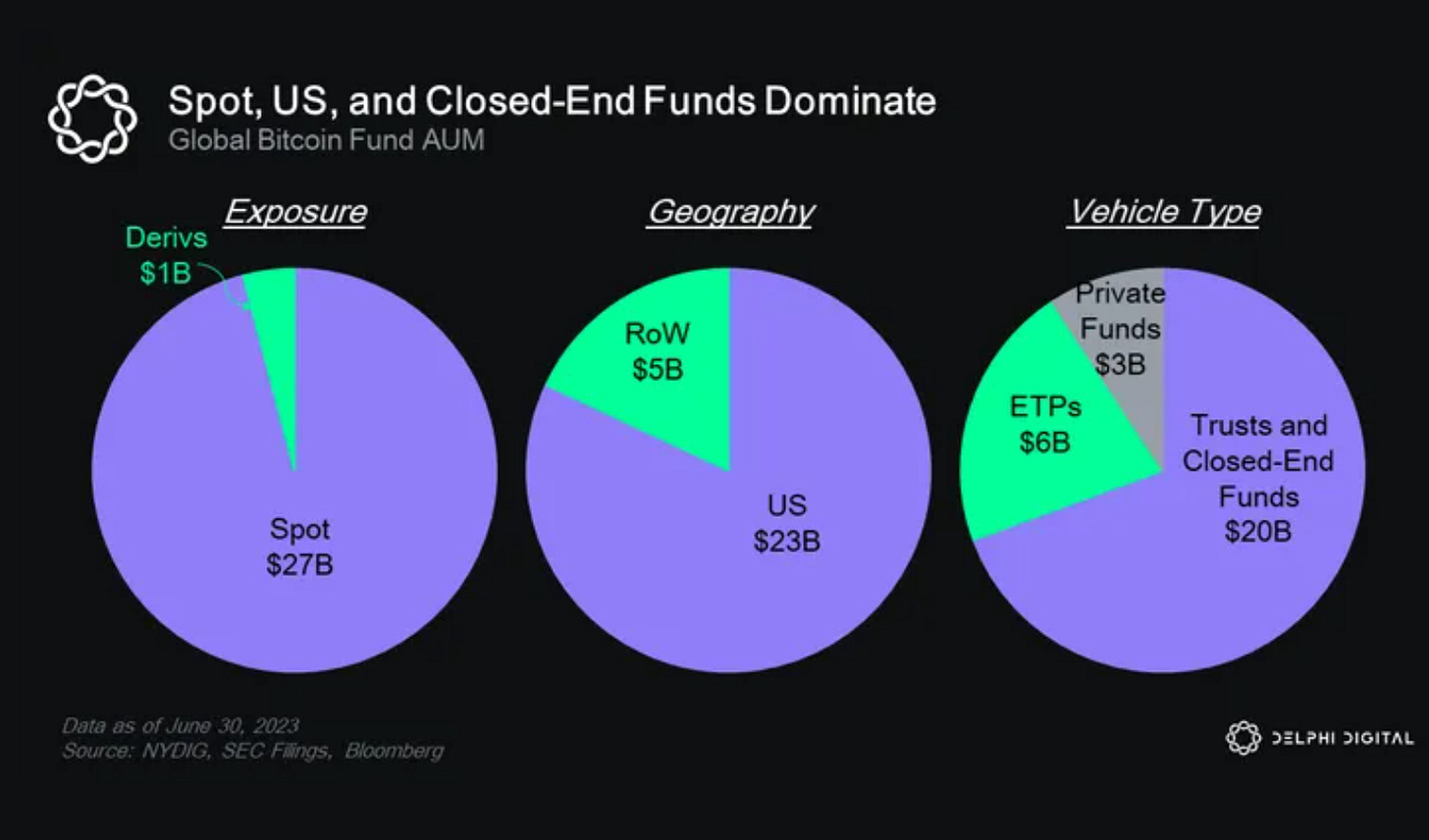

There is ~30B worth of BTC AUM between ETPs, private funds, and trusts/closed ended funds. Gold ETFs have 210B of AUM (as of Jun ‘23). If we assume, conservatively, the BTC spot ETF accrues 20B of AUM over the next 2 years, that’s 10B worth of buying pressure per year. This is 27.5M of buying pressure everyday.

BTC miners HODL strategy

Miners currently account for 25% of the total hashpower. This means they accrue ~25% of the produced BTC. Many of these BTC mining companies adopt a hodl strategy (don’t sell all of their mined BTC). The amount hodl’ed goes up as we transition into a bull market. If we assume 25-50% of produced BTC hodl’ed (from this point forward), that’s a 6.3-12.5% reduction in net BTC supply overall. For reference:

Mara holds 11,466 BTC

Hut8 holds 8,388 BTC

Riot holds 6,974 BTC

Nation states/companies

From last bull to now:

TSLA holds 9,720 BTC

Coinbase holds 9,480 BTC (not customer funds, their own balance sheet)

Square holds 8,027 BTC (not customer funds, their own balance sheet)

Nexon holds 1,717 BTC

El Salvador holds 2,381 BTC

As this cycle continues, I expect more and more companies and nation states to follow.

—

Bear market trauma can be real. It’s been a rough ~2 years so far, we’ve experienced:

a domino of collapses across some of the biggest players in the industry (3AC, FTX, Luna, Genesis, etc), the fastest

the fastest interest rate hikes in history

a brutal onslaught of SEC attacks

Considering everything I’ve listed, I’m pretty sure 99.9% of us are underestimating how insane the next bull run can really be.