Bitcoin Miners Thesis

BTC beta

In this piece, I’ll cover:

Overview: BTC miners

My thesis for buying BTC miners

Some common risks/misconceptions

Overview

BTC miners compete to solve very difficult cryptographic problems. Whoever solves it the fastest gets the block reward – bitcoin

In the long run, a miner’s hash rate (ability to solve these difficult cryptographic problems) divided by total network hash rate determines their proportion of block rewards. For example, if entity A owns 10% of hash power, in the long run, they will mine 10% of the btc produced

BTC miner’s business model can be simplified as: trading electricity, hardware, and upkeep costs for bitcoin

The key metrics for each miner is:

Net revenue per BTC (BTC price - costs to mine 1 BTC)

% of total network hash rate

Balance sheet management (how much debt, cash, and Bitcoin they hold)

Thesis: Bitcoin price up, Earnings up, Multiple up (Bonus: Fees up)

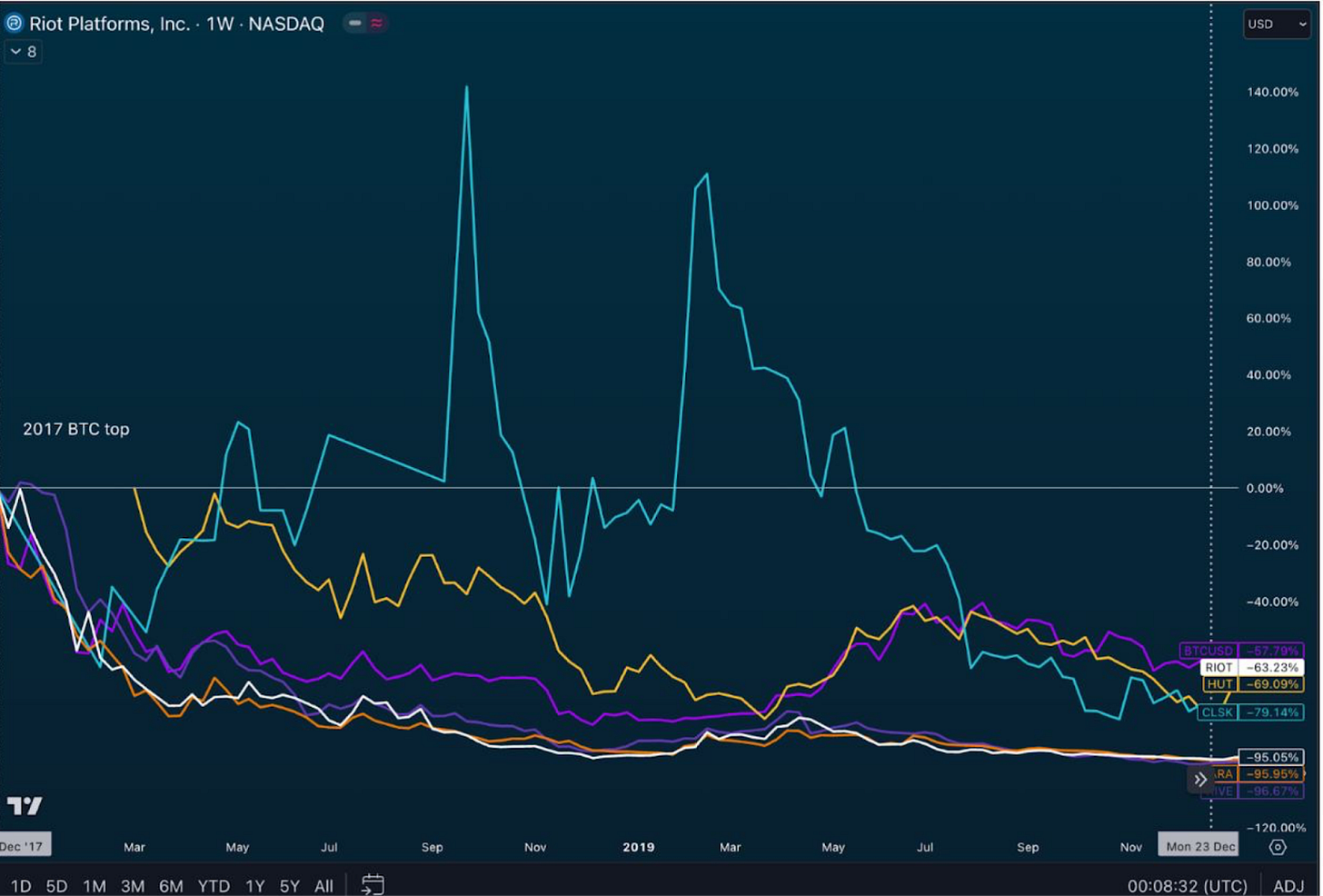

Miners outperform immensely when BTC is in an aggressive uptrend, and they underperform massively when BTC is in a downtrend

This makes sense considering the fundamental approach to valuing businesses — on the uptrend we get earnings growth + multiple expansion, and on the downside earnings decline + multiple compression

The time to buy miners is after a period where net revenue per BTC mined has been on a downward trajectory for some time – this is where perception, sentiment and future projections are much more negative than reality

The bottom for most miners happened during the covid crash in Mar 2020. However, if you look through their charts, they look like they bottomed during Dec 2019, 6 months pre-halvening

Why is the the halvening so significant? It is because BTC emissions gets cut in half. For miners, this means the cost to mine one BTC doubles. If the price of BTC doesn’t double, the business model for miners gets worse

Once that massive uptrend starts, net revenue per BTC starts increasing for the miners. The revenue growth rate starts to accelerate. So in addition to an increase in earnings, these miners also get multiple expansion — this is where they really start to outperform

This cycle, we’ve seen multiple innovations spur up along the Bitcoin “NFT” space – ordinals, inscriptions, BRC-20s. As a result, block fees have risen substantially during periods where BTC NFT activity is up

In the past few weeks as well as in May ‘23, we saw BTC fees average 1-2 BTC per block. This is 15-30% increase in btc to the miner

I think now is a great time to start building a position in these miners

Perhaps we can go lower, but considering how much higher we will go, and the new innovation in BTC “nfts” (and the higher fees that come with it). The R/R makes sense. I am not in the business of trying to time the pico-bottom

In summary, this mispricing on BTC miners can be boiled down to two reasons:

1/ The cyclicality of Bitcoin prices isn’t consensus, (particularly from Wall St PoV), however the halvening event is a well known event

2/ 99.9% of Wall St have never heard of the word ordinal, the other 0.1% think “ordinal” is a word related to number theory

Common risks/misconceptions

Bankruptcy

As we approach this time in the cycle, there are more whispers of bankruptcy around miners. This makes sense as a result of the halvening (costs double to mine 1 BTC). You can mitigate this risk by:

Buy miners that will have a positive net revenue per BTC mined

Taking a glance at miner’s balance sheets to gain an understanding of how much runway they have

These miners that score high here are typically well managed, and also adopt a reasonable hodl strategy (holding their mined btc vs. dumping it immediately)

My personal two favorites are RIOT / CLSK, with MARA being a close 2nd

Dilution

If the company is diluting to fund 1) acquire more hashpower or 2) increase net revenue per BTC mined this is generally bullish. Why?

1/ Share price = Market Cap / Shares outstanding

2/ Market Cap = earnings * multiple

As a result of 1/ + 2/, earnings growth + multiple expansion will typically have a net positive effect on share price vs. share dilution

Take a look at how RIOT/MARA shares outstanding grew through 2020 and 2021. Then take a look at how their share price moved

Won’t the BTC ETF detract from BTC miners?

Anything that helps BTC price increase will be beneficial for the miners. If people bid up the BTC ETF, this means BTC price increases.

The downstream effect is that miner revenue increases (and hopefully, also grows faster as a result of the BTC ETF remove friction for people to buy BTC)

Why miners over BTC / BTC ETF? COIN? MSTR?

BTC — If BTC price goes up, your BTC will go up accordingly (similar with your BTC ETF). This is fine, but if you expect BTC to go to 100K over the next 12-18 months, you may want higher beta exposure

COIN - COIN provide some exposure to BTC (BTC etf custody, BTC trading volumes, holding BTC on their balance sheet) but their exposure is spread across the rest of the crypto ecosystem. If you want more exposure to BTC (esp leveraged exposure), BTC miners make more sense

MSTR - MSTR actually is a decent proxy – they’ve done a great job at taking out loans during frothy times on extremely favorable terms. However they don’t benefit as much from the earnings growth (including the ordinals/brc-20 eco) and multiple expansion

You need to revisit the difficulty adjustment algorithm. The whole post is based on a false premise!

Hey Jay, I’ looking to buy options for the two best ones; to avoid risk of being prematurely liquidated with an higher exposure.

What shoukd i look for ? January 2025 ?