Analyzing the Base <> Optimism deal

Smart move by both

About 6 weeks ago, Base struck a deal with Optimism. It’s something that seems under looked – I didn’t see any mention of this on cryptotwitter or on the number of newsletters I keep up with.

The deal is: in exchange for the greater of (a) 2.5% of Base's total sequencer revenue, or (b) 15% of Base’s net on-chain sequencer revenue (L2 transaction revenue minus L1 data submission costs), Base will receive 118M OP tokens that vests over the next 6 years.

This deal reminds me a lot of when Didi (Chinese ride sharing app) bought out Uber in 2016.

I will share my thought process from the perspectives of both Base and Optimism.

Overview

Optimism is one of the pioneering L2 projects – they launched nearly 2 years ago (Dec ‘21). Time flies.

Most recently, they’ve focused on building out an infrastructure that can be used to easily spin up new L2s – the OP stack. This is also what Base is built on.

Base is an L2 built by Coinbase on the OP stack. Similar to other L2s, Base’s revenue comes from transaction fees minus L1 settlement costs.

Base launched at the end of July. Since then, they’ve cleared nearly 8M dollars in fees. Base also has 337M in TVL.

During this period, Base is arguably the most successful L2 (activity, fees, growth), surpassing Optimism and Arbitrum and eating up a significant portion of market share within the L2 space.

The L2 Wars

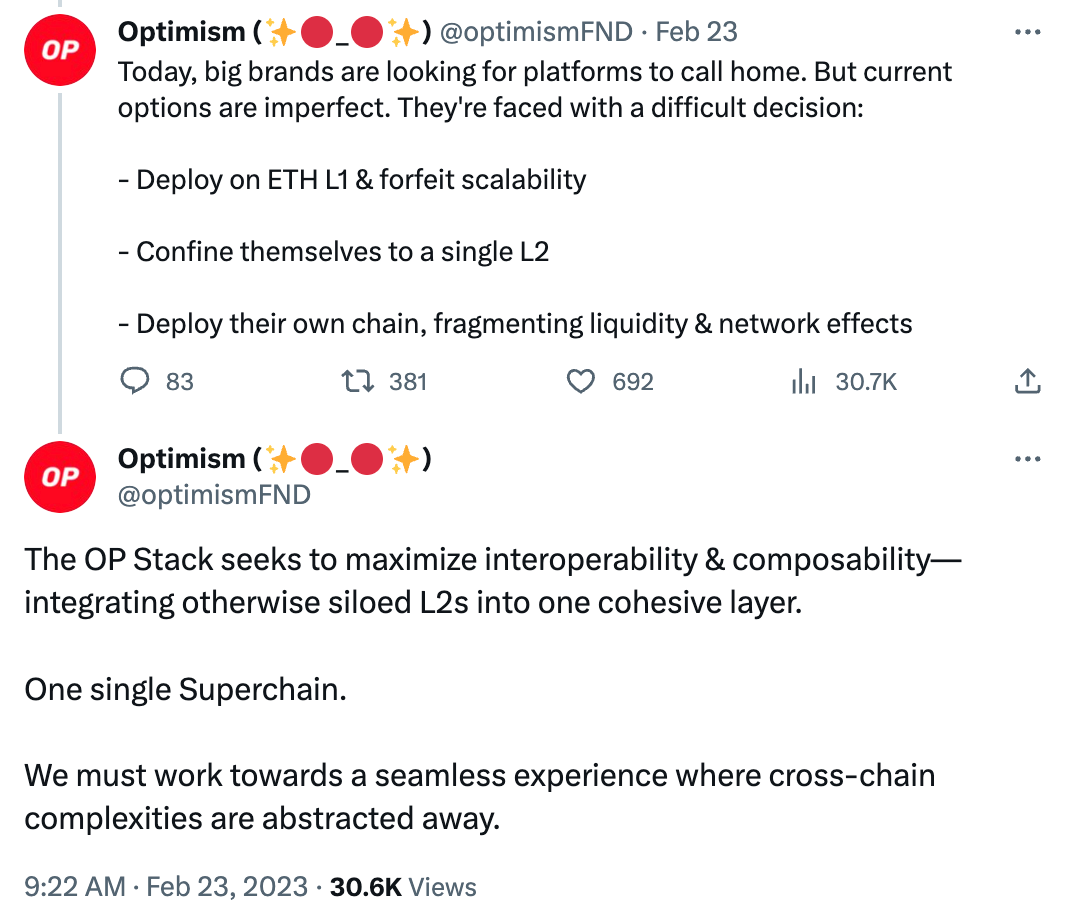

Vance thinks there will be hundreds to thousands of L2s that pop up in the next year. This will cause many issues, as I’ve covered in more detail here.

One of the most concerning issues is fragmented liquidity — due to the friction around bridging, there isn’t one centralized L2 to transact on. This means that developers will need to either integrate their d’app into multiple tech stacks (more repetitive, toilsome work) or get into the game of predicting which L2 is the most popular. This pain point is well understood by Optimism and is the motivation behind the OP stack.

Base

From the perspective of Coinbase, this deal serves two purposes:

It allows them to participate in Optimism’s upside (via the $OP token)

Serves as a proxy to them issuing their own token (more important)

To take a step back, why would an L2 want to issue a token in the first place?

Decentralize governance (many different entities can now participate) and

Generate value by capturing the existing liquidity within the market

I believe 2 is the primary benefit given the current market conditions.

A common way to value companies or protocols is to do a discounted cash flow (DCF) and assign a multiple based on a number of factors such as competitors, growth rates, churn. A DCF effectively allows you to “time travel” in that you can bring future revenue into the present day (adjusting for rates, opportunity cost, etc). This is one of the reasons why going public (in traditional markets) is so revered – it allows you to compress future earnings into now. If you assume you are a better capital allocator than the broader market (which founder doesn’t think this way?), this gives your more $ in the present, which allows you to further accelerate your growth.

However, with Base (and Coinbase), there are regulatory and legal concerns to releasing a token. Coinbase is in the midst of a number of legal cases around securities law — winning these cases is vital to the health of their business. It makes no sense to jeopardize this with the launch of a BASE token.

BUT, it’s clear that this is something they’ve though about.

It’s interesting to see the messaging go from “Base has no plans to issue a token” to:

Coinbase has a found a loophole around this: by trading off future revenue for OP tokens, this serves as a proxy for issuing a Base token directly.

Optimism

For Optimism, this is effectively an OTC deal on their OP tokens for Base’s future revenue/net profit. But does the price that they paid make sense?

(For simplicity, I will just consider 15% of their revenue instead of net profit)

Let’s do some quick math:

In the last 10 weeks, Base has done ~8MM in revenue.

15% of that would be 1.2MM => 5-6MM annually (conservatively)

The exchange is 5-6MM for ~20M OP tokens annually

The math works out where each OP token is worth 25 to 30 cents

Considering this deal was done at the end of August, the implied price on OP is lower than this (as Base activity has grown substantially since).

In any case, this likely undervalues OP, considering 45c was the market low post airdrop. As of Oct 10, OP is trading at $1.23, but at the scale at which they are trying to get liquidity, it’s clear that the market can’t absorb this without significant price impact.

Ok, so why did Optimism agree to this?

To put it simply, Optimism believes that the expected L2 market share that Base + Optimism mainnet would capture is higher than the pro-rated share that Optimism mainnet would capture alone. Additionally (and related), the other implication here is that Optimism believes that Base will grow significantly over the next 6 years.

Base would need to 4-5x their revenue for the implied OTC deal to be the current market clearing price for OP. It’s hard to imagine this being the case as of this moment, but with FriendTech and Aerodrome, there is clearly demand for Base.

This also suggests Optimism is really looking for liquidity on their tokens. This makes sense considering only ~20% of the token supply is circulating. They are trying to get ahead of the unlocks and vesting that is to come and what that will likely do to the price of the OP token.

Conclusion

To conclude:

Coinbase can’t tokenize Base due to legal + regulatory reasons, but it is clear that this is something they’ve been actively thinking about

Tokenizing effectively allows Base to bring future revenue to the present – which would allow for more resources, allowing them to grow faster than they would otherwise

Their deal with Optimism is a proxy to issuing their own token (15% of their revenue or 2.5% of net profits for 118M OP tokens)

Optimism needs liquidity on their tokens (and wants to get ahead of the vesting/unlocks)

At present, this deal with Base is effectively selling OP at 25 to 30c (it’s trading for $1.23 in the market as of Oct 10)

To extrapolate, this is more of hedge for Optimism, allowing them to take a short $OP, long Base revenue growth (and by proxy activity growth) with part of their stack

Great write up man. Cheers

Very well written!