AWS of the EVM Ecosystem

Eigenlayer? Isn't that a linear algebra operation?

This article was originally put out on Aug 27, 2023, but with the recent restaking cap limit raise I thought I’d resurface this.

Some updated thoughts:

The concept of restaking is great and the intention to utilize ETH’s security in bootstrapping middle layer infrastructure is very innovative

There are a lot of risks here especially when we continue the liquid token paradigm. Liquid restaking and composability are great in practice but will present systematic risks if we move too fast and too aggressively

Complexity begets volatility

In the context of scaling web2 tech companies, compute + memory are two of the most crucial resources.

A few decades ago, when it came to scaling, every tech company had headaches over finding the right approach to scaling while balancing the costs associated with it.

Today, a similar problem exists within the EVM ecosystem – how can you bootstrap a validator network efficiently?

For most protocols, figuring out the right incentive and security models are a pain in the ass. Wouldn’t it be nice to take advantage of the security network that ETH has already built?

Similar to how AWS was able to abstract and package away compute (and memory) as a service, EigenLayer is taking a stab at enabling validators as a service.

So what is exactly the issue?

We've all heard of ChainLink. It is the oracle that allows data from outside of blockchain networks (e.g. price of the SP500, fed funds rate) to be imported into blockchain networks. Given how important this is for all of DeFi, you don’t want a single entity controlling the pricing data.

For ChainLink to operate in this manner, it needs a set of validators set up with the right incentives to enable accurate, timely pricing data. In other words, how do you set up the system so every actor is behaving rationally to enable the correct data to be imported?

The way this has been done in crypto is via staking -- a set of validators put up an economic stake, ChainLink pays them for behaving (importing accurate, timely pricing data), and you penalize them (slashing) for incorrect behavior.

But how does this work when the network is first starting up? During this initial phase the network has no revenue. How do you bootstrap the network to begin with? To do so usually requires a lot of capital to acquire the initial set of validators.

EigenLayer Restaking

Now, enter EigenLayer and restaking. Currently, Ethereum has 50B dollars of staked ETH. DeFi is all about capital efficiency – can we reuse this ETH?

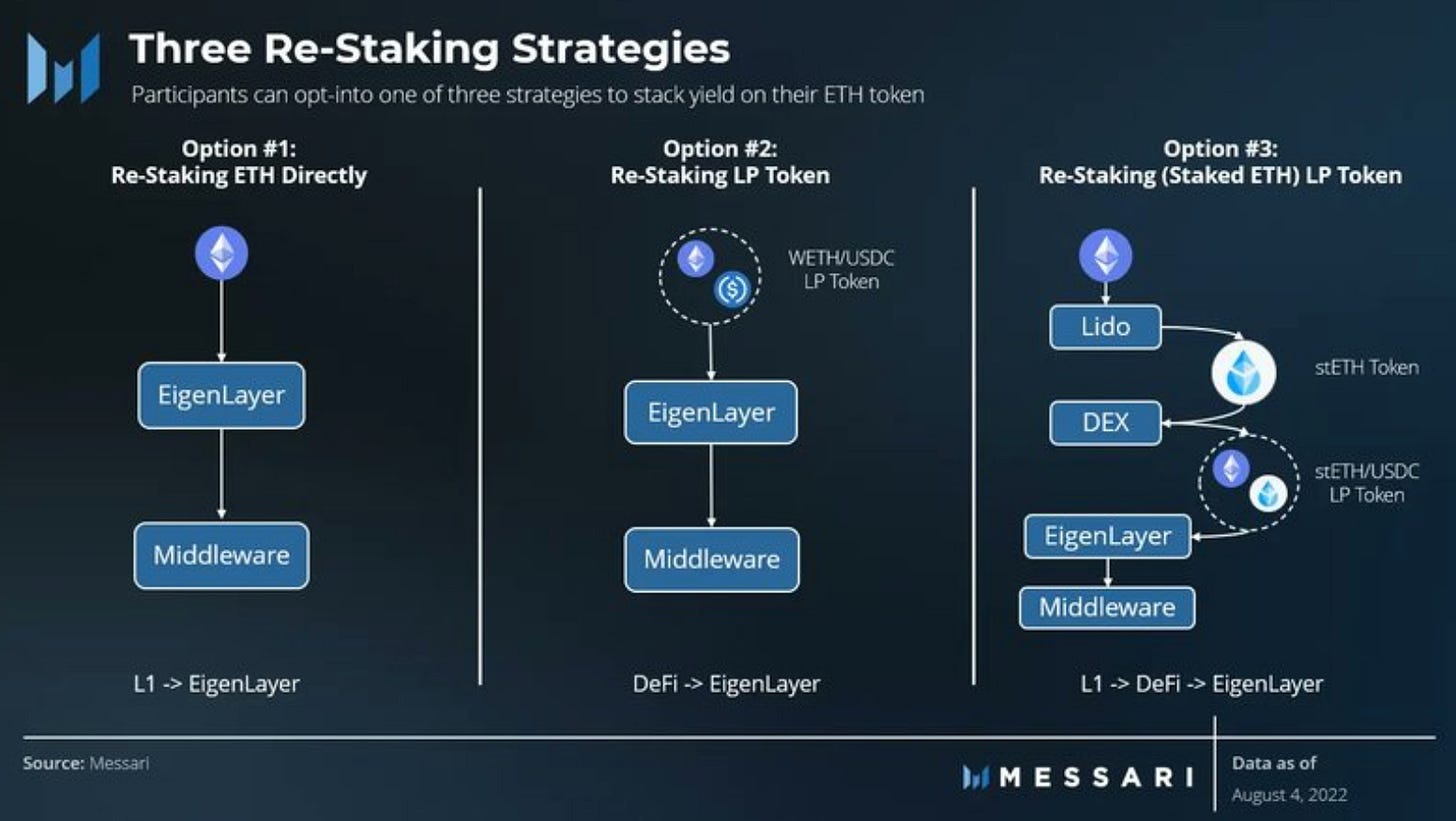

Eigenlayer sets up a smart contract restaking - restaking allows validators to reuse staked ETH as a form of economic stake. The smart contract encapsulates the logic to manage risk across the different middleware layers as well as the distribution of collateral across validators. It also augments the slashing conditions, accounting for the additional criteria that these protocols require.

To distill the incentives, restaking enables 1) ETH stakers (native staking and LSTs) to earn extra yield and 2) middle-layer protocols to bootstrap their validator network.

Eigenlayer operates as a free market, allowing validators to sell this restaking service to any protocol. It has a rebalancing and algorithm to ensure that the ongoing stake and security capacity are managed.

In more concrete terms, if Chainlink was first starting, there wouldn't be as much focus on setting up the LINK tokenomics to incentivize validators to do the right thing. ChainLink could rely on the EigenLayer restaking market initially. This is one less thing the team needs to think about.

Implications

This means a few things:

ETH accrues even more value as restaking solidifies another key use case

Accelerates innovation within the EVM eco -- just as Stripe, AWS have enabled web2 start-ups to move faster, EigenLayer will do the same for the web3 / crypto ecosystem

Increases the perceived opportunity cost of holding raw ETH over LSTs

LSTs add additional risk, restaking adds additional risk on top of LSTs

Similar to Lido, EigenLayer doesn't own the set of validators nor the LSTs. It facilitates restaking via smart contracts. This has security implications:

Short term this is a honeypot for hackers, the EigenLayer smart contract that enables restaking will be scrutinized for any possible vulnerabilities. Long term

Long term, this is extremely positive for EVM eco security -- as the smart contract becomes tested over time and as it becomes more normalized for protocols to use ETH as stake in their validators

This post is sponsored by Aevo. Aevo is an options/perps DEX built on their own appchain, with one of the best options UX in DeFi - I use them myself to hedge my spot positions in a much more capital efficient manner. They are also super quick in listing the hottest pre launch tokens ($TIA, $BLAST, $PYTH) on their perp DEX

They’ve rebranded from ribbon finance and will be doing an airdrop soon. Use my this link to support me and save fees when you use Aevo

Great explanation! I have one question. How are restakers punished if they preform badly?

Now that EigenLayer has EigenDA it’s like a hybrid Ethereum child of Stride and Celesta. I wonder if the combination is greater than the sum of the parts? What do you think?