A new meta for start-up equity? OpenAI paves the way

How Sam Altman guards OpenAI's upside with an options strategy

OpenAI and ChatGPT have been all the rage as of late, but Sam Altman’s innovation around OpenAI’s equity model may be just as impactful in creating a new meta for all start-ups.

Trading is a zero-sum game, if I make $100, someone lost $100 — whether directly or via opportunity cost. Sam Altman has out traded OpenAI’s employees and investors. How? They’ve taken the strategy of issuing bull call spreads rather than vanilla call options. This is extremely clever, and I’ll explain why.

I cover:

What is a “bull call spread”?

Why is this a clever strategy?

OpenAI can issue out relatively less equity

Hedges against employee (and investor) turnover

Far OTM options are generally mispriced

Conclusion

What is a “bull call spread”?

A call spread is an options trading strategy where you pair a long call with a short call. In other words you buy a call, and then you sell a call with the same underlying.

In particular, a debit call spread is one where you buy a call with a strike price lower than the call that you sell. This results in a net debit.

This is also known as a “bull call spread” since it expresses a bullish outlook. So what does the return profile look like here?

Suppose you bought a $50 call and sold a $55 call. This cost you $2 initially. The maximum profit is $300 if the stock price is above the short call at expiration, and the maximum loss is $200 if the stock price is below the long call at expiration. The break-even point would be the long call strike plus the premium paid.

These spreads are particularly attractive because they provide defined risk / return profiles.

Why is this a clever strategy?

OpenAI can issue out relatively less equity

In traditional start-up funding, a start-up raises money. Then they go and iterate on their product, gain a bunch of users and revenue, and then they raise another round. Repeat, and hopefully, they are acquired, or even better, go through with an IPO.

Within each round, the start-up gives away some of their equity – within each round, more shares / options are issued which ends up diluting existing shareholders.

But what OpenAI has done here allows them to mitigate this issue.

For simplicity and illustrative purposes, let’s say OpenAI’s cap was 10x. Suppose their seed round was done at a 10M valuation. We can think of the 10x cap as effectively a covered call (technically a poor man’s covered call) against their equity.

Suppose investors put in 1M and are granted 10% of OpenAI’s equity within the seed round (10M valuation post). OpenAI builds a great product, and is looking to raise 10M in their next round at 100M. Since they possess the call options aka the 10x cap, they can now sell these to the next round of investors without issuing out any new equity.

This is a simplified model, but illustrates how OpenAI may issue significantly less equity.

Hedges against employee (and investor) turnover

The skillsets necessary to take a start-up from 0 to 1 are not the same as what is necessary to go from 1 to 1000. Scaling a product and organization is very different from finding product market fit. When you scale – politics, hiring, organizational charts becomes much more relevant whereas during the early days – being nimble, doing things that don’t scale, and remove processes is crucial.

Likewise, early stage employees, particularly the ones that were vital in finding product market fit, don’t enjoy working on larger organizations with org charts and bloat. THe same can probably be said for investors

By issuing themselves a deep OTM call option, they are effectively hedging the case where early employees leave after the company enters a new stage of growth. This caps what would be unlimited upside and transfer that back to OpenAI.

Similar reasoning applies to investors (e.g. YCombinator may not be as valuable vs. A16Z / Sequoia in helping scale or going public)

Far OTM options are generally mispriced

I’ll go a little deeper on options in this section – so feel free to skip if that’s not something you are interested in

So deep OTM options are hard to value, and they are even harder to value if the underlying is an illiquid asset like early stage start-up equity.

If you look at it from the perspective of an early stage investor or employee – the consensus is that most start-ups don’t make it. As a result, their equity trends towards zero

Here’s a memorable example – if you had taken Fast’s burn in 2021 and put it a savings account paying 0.75% APY, they would’ve netted generated more revenue.

Ok so how can we attempt to value what these deep OTM call options are worth on in an early stage start up (OpenAI)?

So here’s what we know:

OpenAI raised their seed round sometime in 2019

As of late 2018, CBinsights estimates the chance of startups becoming a unicorn (valued at 1B or more) is 1%.

The average pre-money seed stage valuation was somewhere between 7-8MM

Given that we have Sam Altman, who most would consider to be a superstar founder, leading OpenAI, let’s use the following assumptions:

Seed stage valuation 10MM post money

3% chance (3x prior odds) of hitting unicorn status

Using the 100x cap as provided in the OpenAI blog, hitting unicorn status would mean turning that deep out-the-money (OTM) call option into one that is at-the-money (ATM)

So how can we go put an actual number on what this return profile would look like?

For simplicity, let us assume:

Option delta serves as a reasonable approximation for likelihood that the option falls in-the-money (ITM) by expiry (e.g. a 3 delta call option has a 3% chance of expiring ITM)

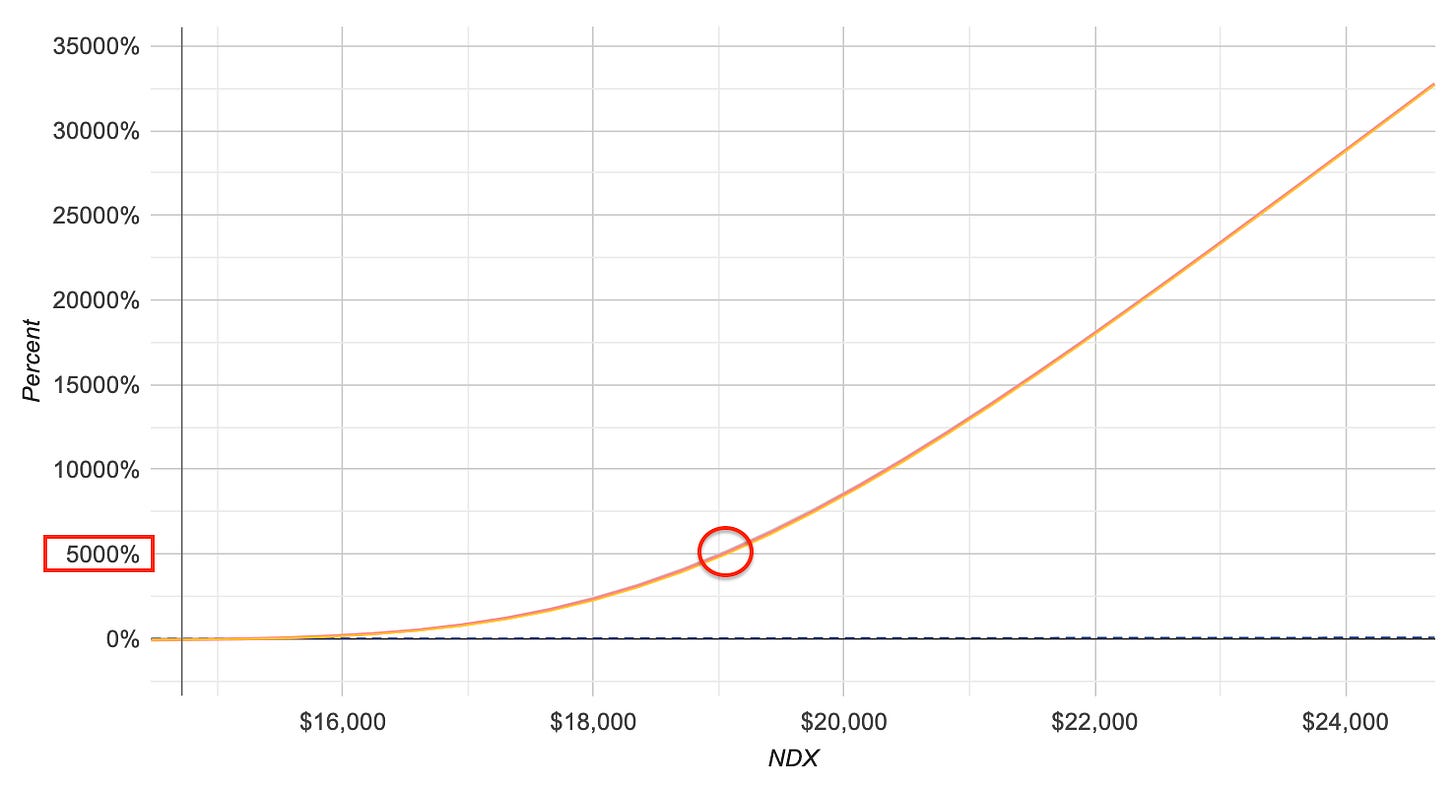

Let’s use the Nasdaq-100 (NDX) as the underlying as an approximation of how these deep out the money (OTM) options are priced

As of Oct 1, 2023, NDX is quoted at ~$14,700. So how are the 3 delta call options priced?

A 3 month to expiry (Dec 29, ‘23), 3 delta option has a strike of $17,500 with a bid / ask of $9.90 - $13.80 – somewhere between 6-9 bps.

A 6 month to expiry (Mar 28 ‘24), 3 delta option has a strike of $19,100 with a bid / ask of $14.20 - $19.30 – somewhere between 10-15 bps.

So in reality it isn’t much, but how does the pricing change with respect to price of the underlying?

From this return chart, it’s clear that from the current price ($14,700) up until the strike price ($19,100) there’s an acceleration in the returns (this acceleration is due to option delta / gamma and out of scope).

Notice that the result is a 5000% return if the option goes from being deep OTM to ITM. Yes, the DTE is held constant but that is representative of the startup equity call options as they should have either a 7 year lifespan (or doesn’t expire at all).

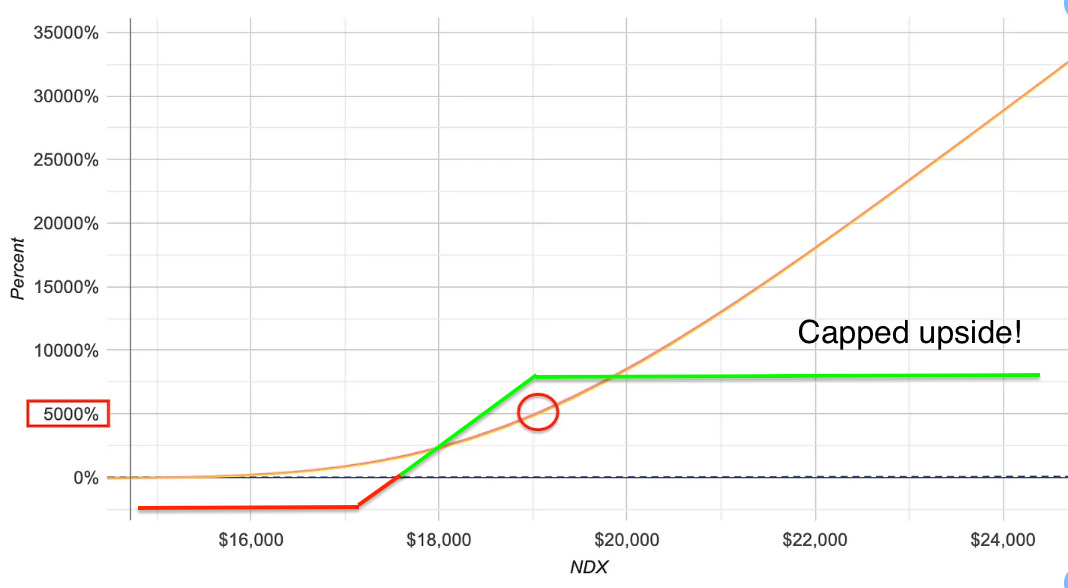

Remember the call spread profit/loss illustration earlier? Let’s overlay it over the NDX long call option return profile.

The upside still exists clearly, but who is the beneficiary? OpenAI.

And now the question to ask is — where is this upside coming from if OpenAI ends up hitting unicorn status? It is the upside that OpenAI has taken back from early investors and employees.

Conclusion

Start-up equity options can be difficult to value. Why? Conditional probabilities, and in particular the extreme right curve outcomes are hard to reason about.

Sam Altman and OpenAI structured the equity for early employees and investors in a way where they retain the uncapped upside. He’s also done so in a sneaky fashion — it is hard to think through and value an extremely deep OTM on the illiquid asset that is early stage start-up equity.

Without knowing the exact details, it is hard to ascertain whether they gave out more equity (but with a covered call attached to it) than they would’ve with vanilla call options.

As Nassim Taleb has said “Short the middle, long the wings” – Sam took his advice, effectively betting on OpenAI (aka himself) and I’m sure its paid off magnificently as a result.